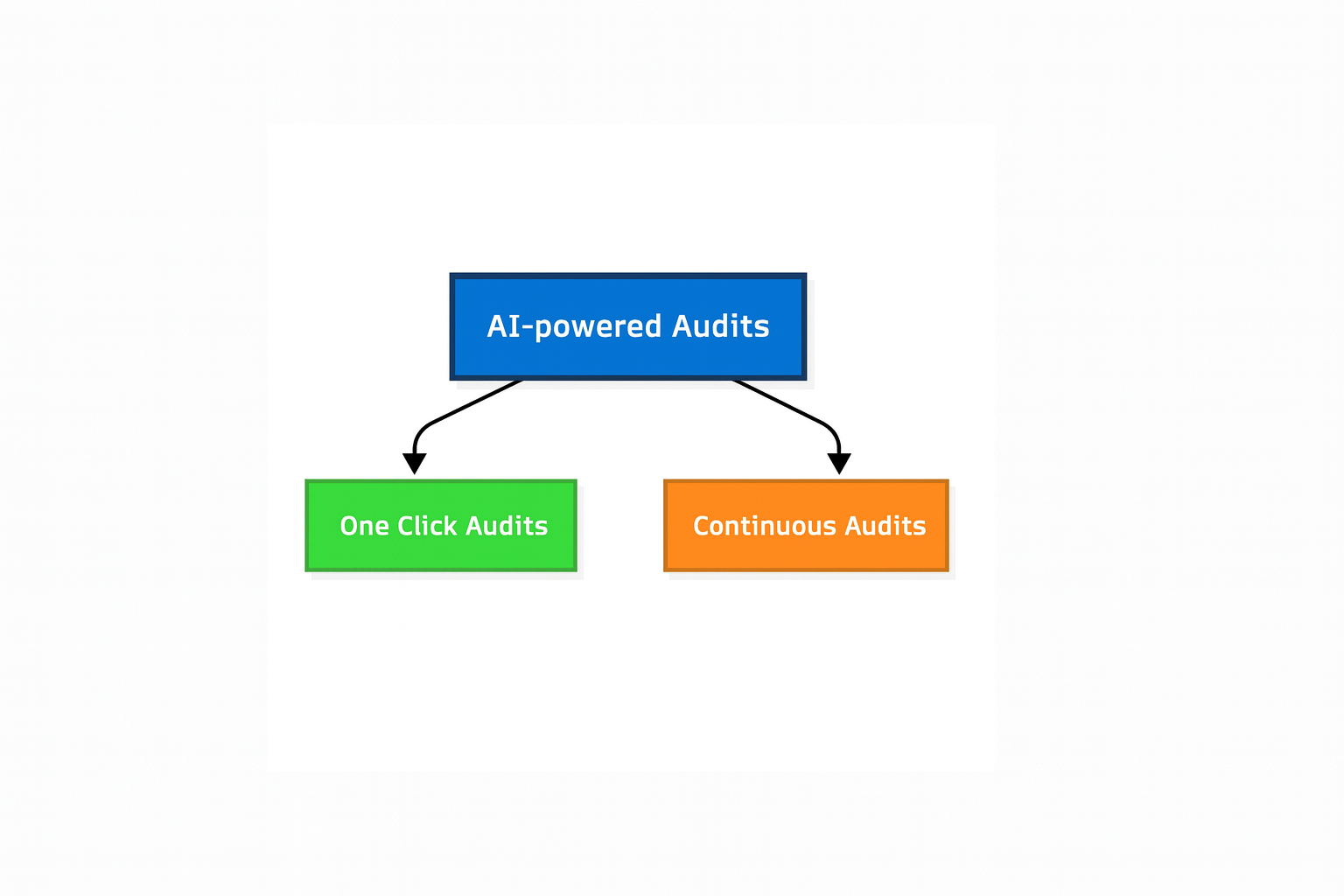

Two Paths for the Future of AI in Auditing: One-Click vs. Continuous Audits

As AI reshapes the auditing landscape, two distinct paths are starting to emerge. These are future states, but the picture is becoming clearer. On the one hand, we have the vision of a "one-click audit," where all client data is gathered and fed into an AI platform. In a single upload (i.e., “click”), the audit is completed by AI agents and delivered to the auditor for sign-off on the audit with minimal manual intervention.

On the other hand, we have the concept of a "continuous audit," where the auditor’s systems are integrated directly with the client’s internal data sources. This means data flows in continuously, and the audit can occur in near real-time without waiting for batch uploads.

Understanding the One-Click Audit

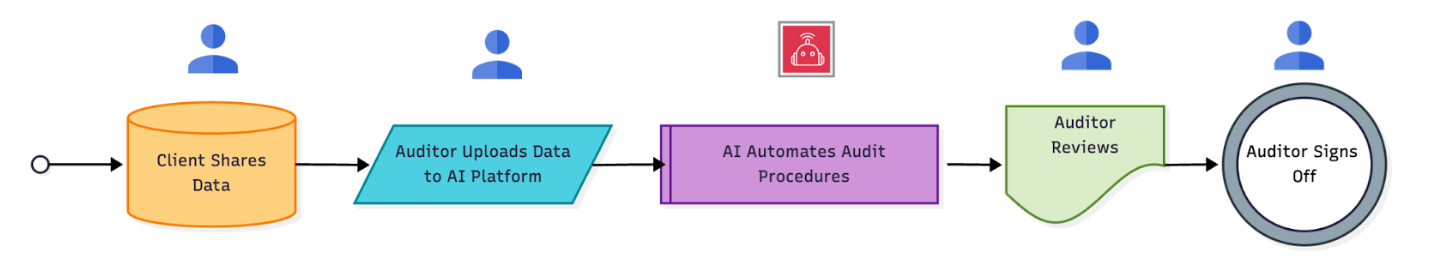

The one-click audit concept envisions a scenario in which auditors collect all necessary data simultaneously, often utilizing AI to process it efficiently. The idea is that the AI handles the heavy lifting, analyzing transactions, checking compliance, and flagging anomalies, so the auditor can simply review the results and sign off. It is a more traditional external audit process, just supercharged by AI.

One Click Audit Workflow.png

Understanding the Continuous Audit

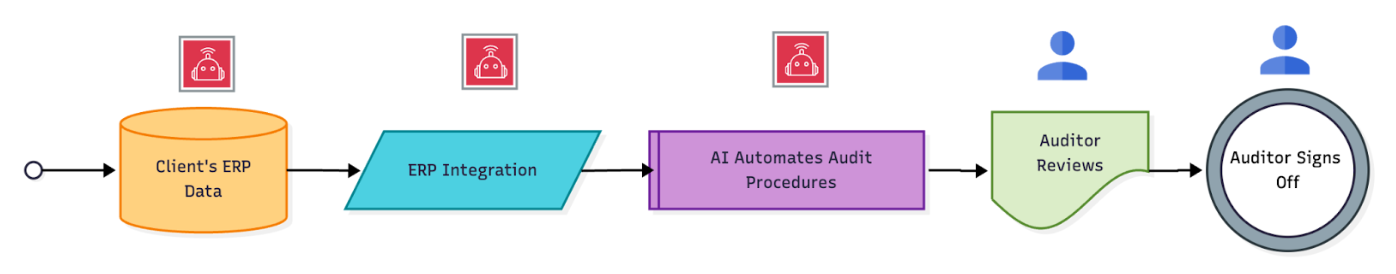

In contrast, the continuous audit involves integrating the audit firm’s systems with those of the client. The auditors can continuously access the client’s live data, making the audit an ongoing process. This removes the need for manual uploads and allows for real-time assurance.

Continuous Audit Workflow.png

Commercial and Regulatory Considerations

Of course, these two paths come with their own sets of considerations. With continuous audits, the auditor gains a much closer, real-time view of the client’s operations, which can blur traditional lines of independence. While auditors can remain independent, it’s a shift toward more integrated oversight. Additionally, clients may feel hesitant about this model because they lose the ability to review and refine their data before the auditor sees it. They might be uneasy about sharing everything in real-time.

In contrast, the one-click audit preserves that traditional boundary, as the client can still prepare their data before handing it over. However, it may not offer the same real-time insights that a continuous audit can provide.

Conclusion

In the end, the future of AI in auditing might not be a one-size-fits-all scenario. Both one-click and continuous audits offer unique advantages, and firms may choose the path that best fits their needs and regulatory comfort. Either way, the evolution of AI is paving the way for more efficient, insightful, and dynamic audit practices.