What does the Audit firm of 2030 look like ?

- Why I’m Writing This

- The Current Landscape

- Re-Thinking the Audit

- Inside the Audit Machine

- What Changes for Clients

- What Changes for Auditors

- The Economics of 2030

Why I’m Writing This

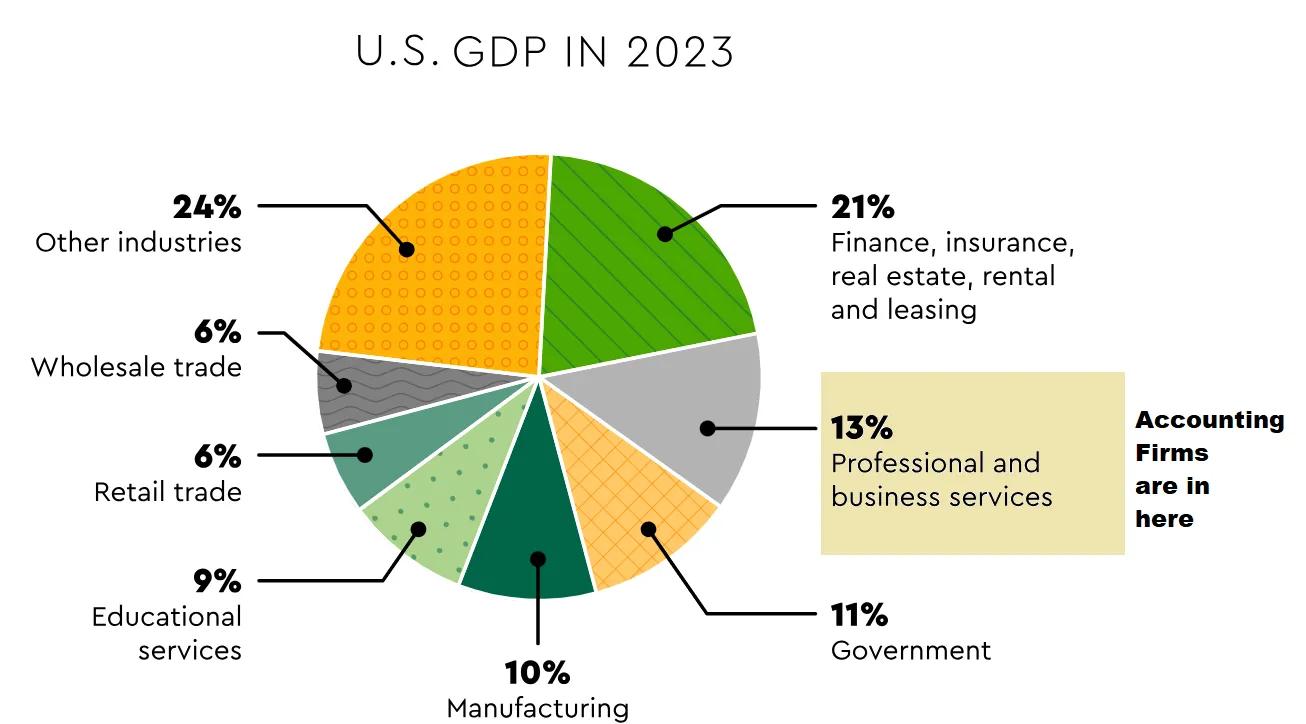

AI is reshaping the accounting profession. And not just accounting, the same forces are reshaping law, consulting, healthcare, education, and almost every other profession built on people delivering services. It’s the same services we talk about when we learn about the constituents of GDP in school. This is the part of the pie that is the largest (particularly in western economies). Over the past century, GDP has shifted from predominantly agriculture, to manufacturing, and now to services as the dominant share. Accounting firms sit squarely inside that category.

U.S. GDP in 2023

There are many ways to think about the transformation that AI can bring to Accounting Firms. One is to see AI as an add-on: tools layered onto the existing models and way of doing work. An enabler for workers to do their work faster and to a better quality.

Another is to take a harder path, and ask the question: what if we started from a blank slate?

This article takes that second path. There are two pieces of content that were particularly inspirational for me choosing the title of this article. I bookmarked them the first time I came across them, and I still find myself coming back to them:

-

“If I Were to Start a Bank Today, This Is What It Would Look Like” — a talk by Nigel Morris, hosted by Peter Renton. What stood out was the rare mindset of designing an institution from scratch. Most executives never get that chance; they inherit decades of systems, processes, and culture. But AI brings us closer to that luxury than ever before. It is forcing everyone to consider the possibility of ripping everything down and rebuilding their organizations from the ground up.

-

“AI Leads a Service-as-Software Paradigm Shift” — research by Joanne Chen and Jaya Gupta at Foundation Capital. This piece reframed AI not as another SaaS tool, but as something that productizes entire services. The critical shift is how to think about market size: the TAM isn’t just the IT spend of customers buying tools, it’s the much larger pool of salaries and service costs tied to people doing the work. The imagination test is: what happens when end-to-end services can be performed almost entirely by AI, with minimal human involvement? This isn’t workflow automation—it’s AI systems solving customer needs directly.

Together, these ideas point to the real question: What would the accounting firm of 2030 look like if we built it from scratch, in an AI-native world?

The Current Landscape

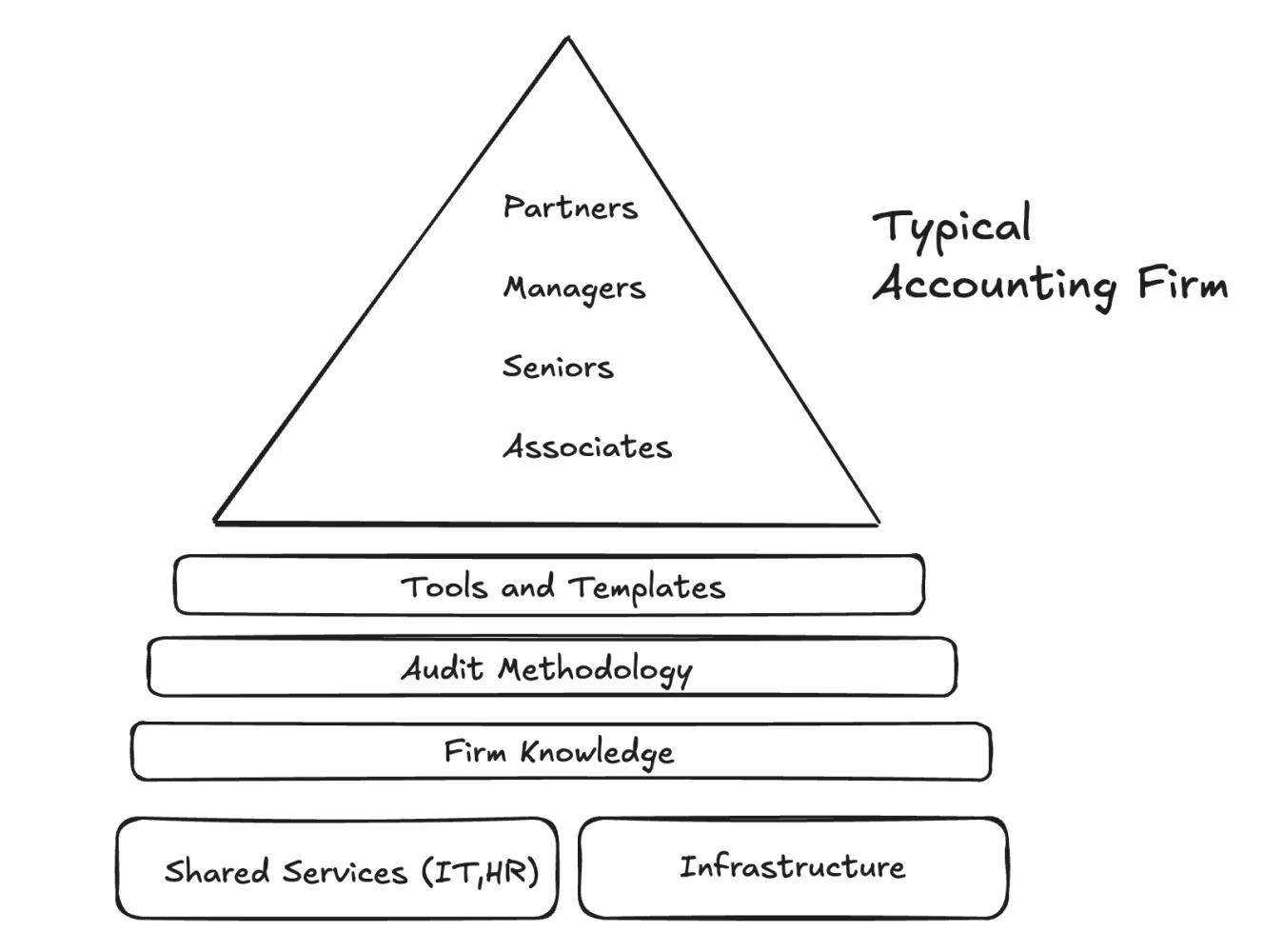

Accounting firms still follow the same pyramid structure that they have always had: partners at the top, managers in the middle, seniors and associates forming the base. And just like before, the pyramid rests on a deep foundation: templates, methodologies, knowledge repositories, infrastructure systems, and the shared services that support the business. Something like this:

Resourcing at a typical accounting firm

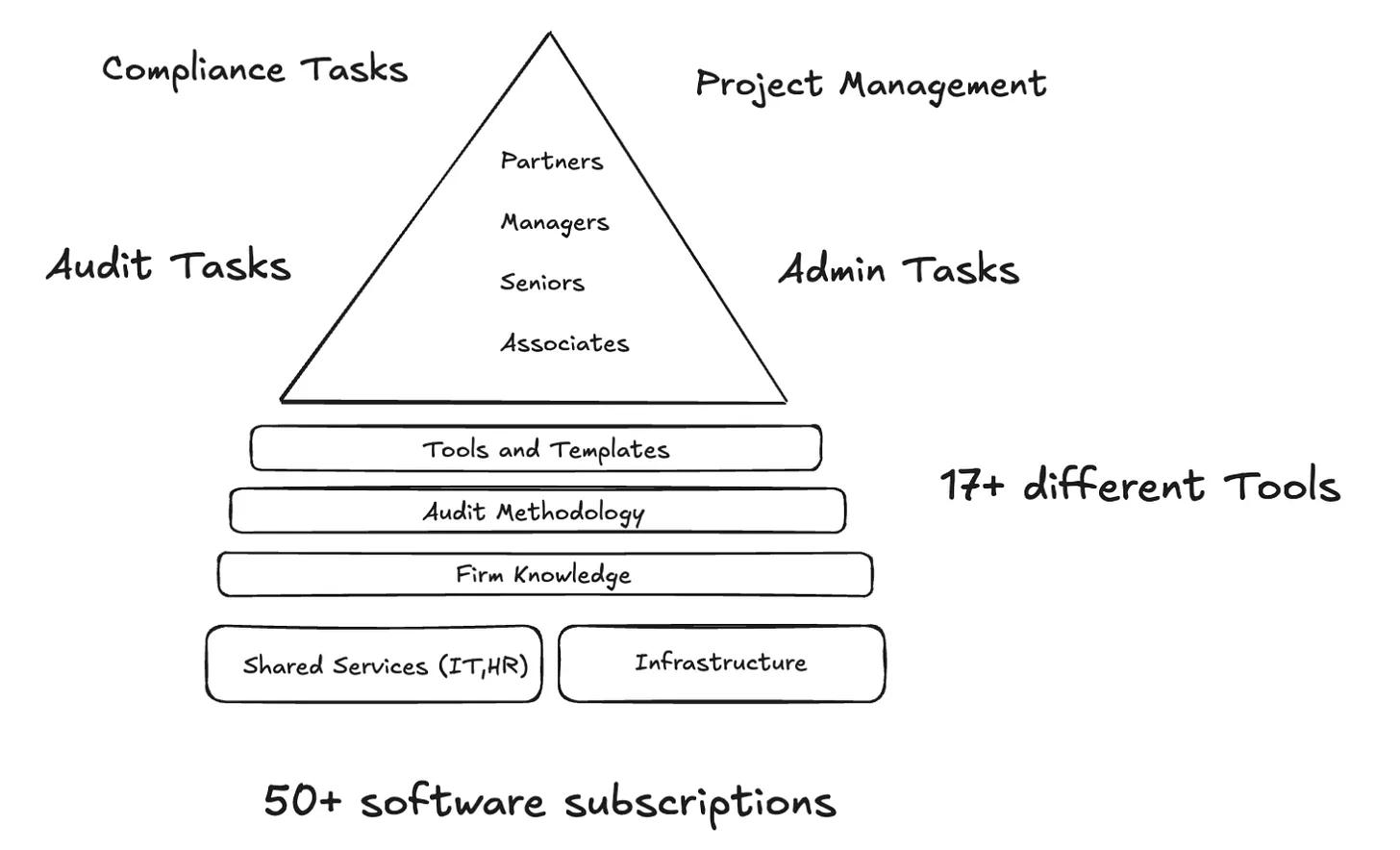

That foundation holds the structure together, but the day-to-day reality is far more complicated. Firms now run 50+ software subscriptions, and people across all levels bounce between tools—on average, 17 per person for a single engagement.

- For associates and seniors, this means constant context switching between pulling client data, testing controls, sending confirmations, documenting workpapers, updating workflows, and clearing review notes.

- Managers carry another layer. They live inside scheduling tools, assigning staff across engagements, tracking budgets and timelines, checking status dashboards, and reviewing chunks of work while still doing their share of testing and documentation. They also spend hours coordinating with clients and partners, chasing deliverables, and making sure everything lines up for review.

- Partners add yet another layer of complexity. They juggle oversight across multiple clients, monitor quality and compliance dashboards, allocate resources, review sensitive areas, and handle client relationships. At the same time, they’re pulled into admin tasks like approving expenses, ensuring independence checks are filed, and signing off on compliance requirements.

The result is a patchwork of overlapping tasks across the pyramid: project management, scheduling, resourcing, task management, compliance checks, client communication, and the endless cycle of administrative activities that cut across every level.

From the outside, firms look modern and digital. From the inside, they feel like an old structure resting on a heavy foundation, entangled in dozens of disconnected tools and tasks that demand constant juggling at every level of the pyramid.

Tasks and tool sprawl at accounting firms

Re-Thinking the Audit

At its core, an audit is about testing whether financial statements can be trusted. Auditors gather client data—trial balance, general ledger, subledgers, contracts, confirmations—and then perform procedures: walkthroughs, risk assessments, control testing, substantive testing, analytics, documentation, and ultimately review. The outputs are the familiar ones: the audit opinion, the management letter, and the evidence package behind them.

But that’s only part of the picture. Around this technical work sits a wide layer of project management and administration. Managers allocate staff across jobs, track budgets, update status dashboards, and coordinate schedules with clients. Partners review sensitive areas, oversee quality, and balance resources across multiple engagements. At every level, there are time sheets, compliance requirements, and internal reporting.

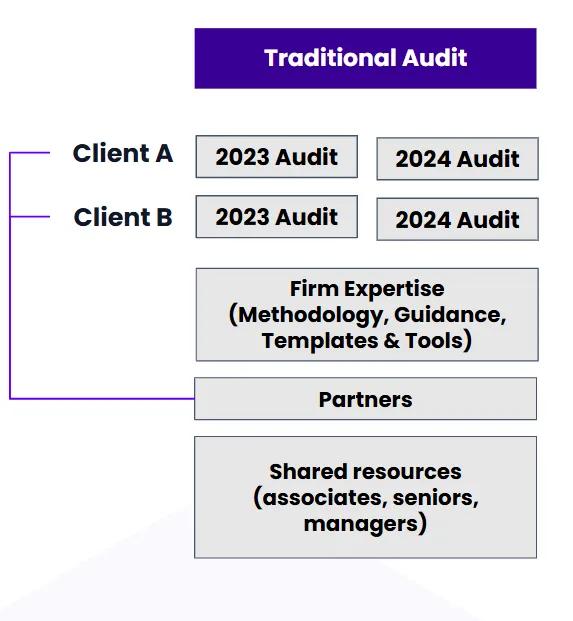

Every audit is also run as a separate project. Each engagement has its own deadlines, team, and deliverables, with managers and partners drawing from a shared pool of people, templates, methodologies, and infrastructure. Around each project orbit the same tasks and tools for data extraction, confirmations, analytics, documentation, scheduling, timesheets, compliance checks. The result is a sprawl where each team essentially rebuilds the same machinery, client by client.

Audits run as projects

The first instinct is to automate pain points. Digitize checklists, make sampling faster, push timesheets into the background. These are useful steps, they reduce friction and save time. But automation alone just speeds up the same old process. The reason the process looks the way it does is because it was designed for a different era.

Re-thinking the audit means going further than automation. It means evolving checklists into dynamic procedures that flex to client risk. It means using client data to expand coverage intelligently, not just pick random samples faster. It means building workpapers that link directly to schedules so tie-outs highlight themselves. It means pulling project management out of scattered spreadsheets and portals into a single system.

The shift is about changing both the unit of work and the unit of value. The unit of work moves from people following steps to systems executing policies. The unit of value moves from hours to outcomes: coverage, assurance, readiness.

Inside the Audit Machine

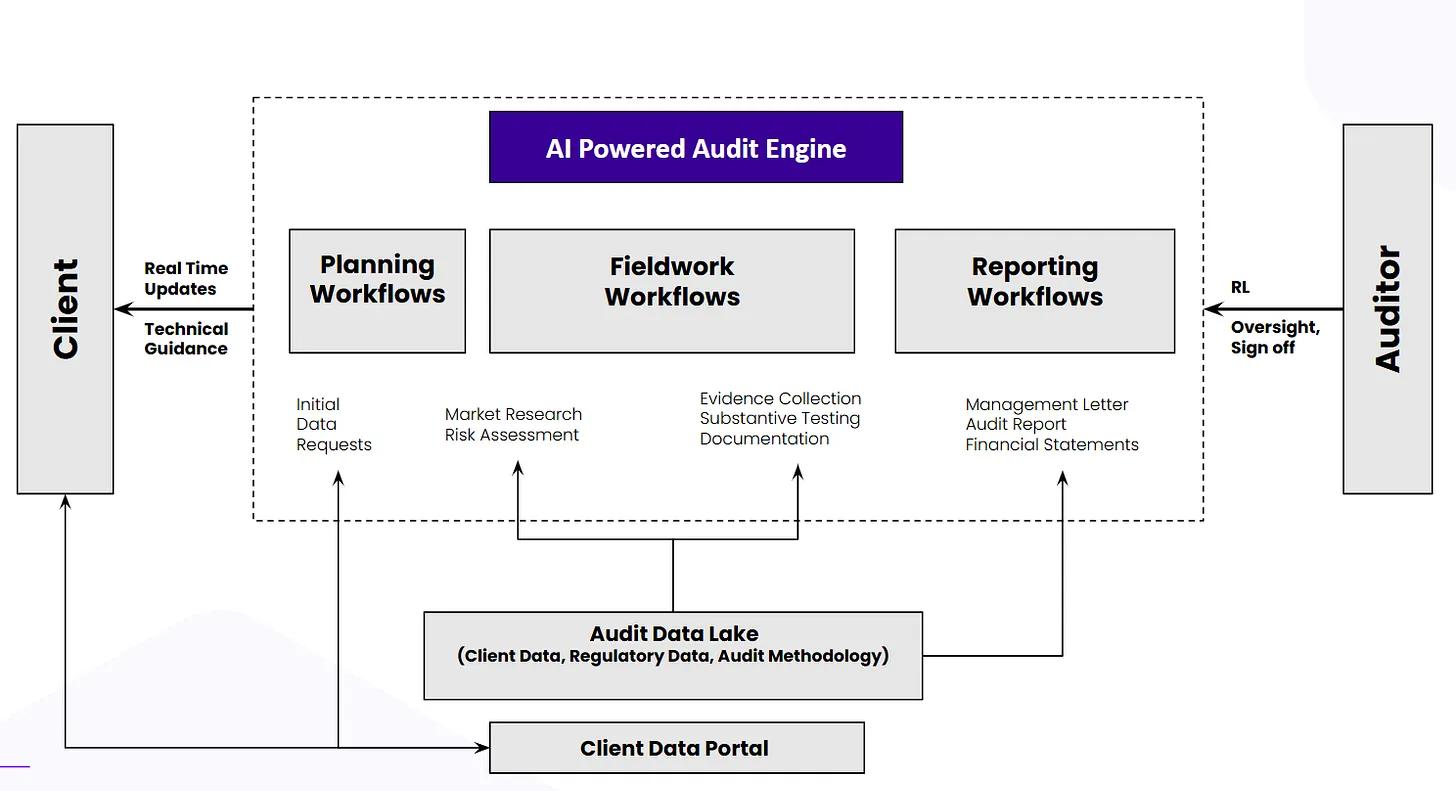

Imagine an AI-Powered Audit Engine where data, policies, and people connect in one system. Clients sit on one side, auditors on the other, and the engine runs in the middle.

The engine is not just about moving data around. It’s about running the audit end-to-end: coordinating requests, executing procedures, tracking progress, assembling evidence, and producing deliverables.

AI-Native Audit

Three categories of workflows operate in sequence but stay connected:

- Planning — scoping, risk assessment, materiality, defining procedures, scheduling resources

- Fieldwork — control testing, substantive procedures, confirmations, analytics, documentation

- Reporting — audit report, management letter, final reviews, closing the file

Each step tracks requests, links evidence to procedures, surfaces exceptions, and assembles documentation. Instead of being rebuilt each time, these workflows are consistent and traceable.

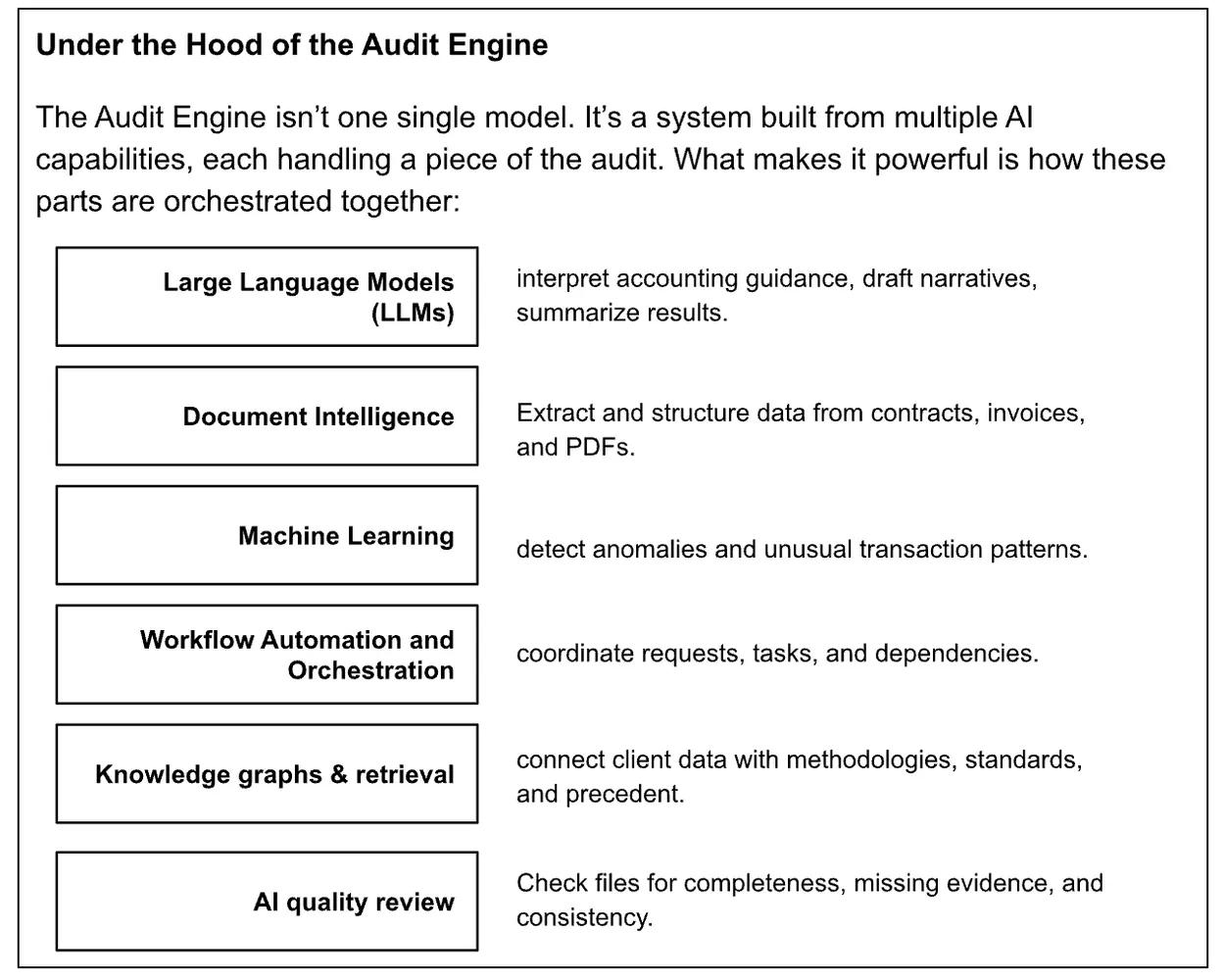

AI stack of the Audit Engine

What Changes for Clients

Today’s audits often feel fragmented. Requests come through multiple channels. Visibility is limited. Progress is shared near deadlines. Clients want insight—but it’s hard to deliver under current constraints.

With an AI-powered engine:

- Requests are structured and connected to procedures

- Missing info is flagged and followed up automatically

- AI reviews documents on arrival

- Clients see real-time status updates

- Exceptions are surfaced early

Clients gain transparency and reduce time on admin. Auditors get more time for insight.

What Changes for Auditors

Auditors today face high admin loads: requests, checklists, documentation, coordination. It stretches hours and limits room for value-added work.

With an AI-powered audit engine:

- Routine tasks are orchestrated

- Repetitive processes (sampling, tie-outs, memos) are automated

- Documents are pre-reviewed by AI

- Auditors focus on judgment, exceptions, and communication

The profession starts to rebalance—more expertise, less grind.

The Economics of 2030

Traditional audit relies on junior staff for margin. But hiring, training, and turnover are costly. Each exit drains time and profitability.

AI changes the economics:

- Reduced dependence on constant hiring

- Fewer hidden costs from churn

- A scalable model based on systems, not headcount

Firms become more resilient. Clients experience more continuity. Audit evolves into a profession focused on outcomes and trust—not just billable hours.