How Accounting Firms Can Use AI to Generate New Revenue

How Accounting Firms Can Use AI to Generate New Revenue?

There is no shortage of AI headlines promising to transform entire industries. But inside the accounting industry and its firms, the reality is more measured, careful and deliberate.

Over the last 18 months, we have spoken with hundreds of accounting firm leaders about AI. Most are interested, many are already experimenting. Leaders want to see exactly where AI will deliver value, asking the hard questions about where it can deliver value, and looking for results that are easy to prove before rolling it out widely. A lot of early projects have focused on productivity. Automating workflows. Reducing manual effort. Freeing up capacity for higher-value work.

Those are valuable wins, but many take time to show results. Revenue-focused AI plays, on the other hand, are different. They are easier to measure, faster to prove, and often get quicker buy-in from partners because they tie directly to top-line growth.

This post shares five tested, practical AI plays that accounting firms can launch now to generate new revenue.

But what’s an AI play?

Advanced technologies have always emerged within the enterprise technology landscape. But revenue strategies enabled by AI typically build upon its ability to leverage data into value propositions, be it internal within a firm, or externally discoverable from both structured and unstructured sources (news, APIs, etc). LLMs are among the crown jewels of AI’s advanced data capability, and LLMs (and all the associated technologies surrounding it) are well positioned to discover, extract, enrich, orchestrate, analyze, and unlock strong value previously deemed impossible. Data is often described as the new oil, but in reality, it is the new sunshine: extremely valuable and near infinite.

Given the cornucopia of near endless data prevalent today, the following table can be used to develop powerful AI-driven revenue ideas:

| Source | Signal |

|---|---|

| Internal | Existing Client Data |

| External | Regulatory Activities |

| External | Publicly Issued RFPs |

| External | Competitive Landscape |

| External | Industry Landscape |

AI tools now exist to discover, extract, enrich, orchestrate, analyze the above signals continuously. And when done right to track client, market, and regulatory activity, it is easy to spot the signals that point to a new need and help partners act on them in real time. These plays are about using the data and capabilities most firms already have today, and combined with AI, they will be able to start more of the right conversations.

Below are 5 such AI-driven revenue conversations that we think most firms have readiness for today:

Cross-Sell Intelligence

Model existing internal client and engagement data to discover cross-selling opportunities of the current client base.

Client Signal Detection

Monitor external client-specific triggers that indicate new service needs.

Opportunity Scanning

Monitor industry news, public events, and filings to identify new client and service prospects.

Regulatory Matchmaking

Track external regulatory changes and match them to impacted clients and prospects.

RFP Discovery

Surface relevant tenders and procurement opportunities automatically.

These plays are not theoretical. They come from our work with firms over the past 18 months. They were shaped in brainstorming sessions with clients, through internal debates inside our own team, and through market research into what is actually working in practice. We have focused on ideas that can be tested quickly, fit into the way firms already operate, and deliver outcomes that partners can see and measure. They do not require a giant transformation program.

Evaluating the Plays

But how to evaluate and prioritize these plays for your own organization? Over the past year, we have discussed/explored several ideas and ways firms could use AI to grow revenue but not all are worth pursuing. Some are too complex for a first project. Others require data or processes that a firm may not have in place yet.

Before we get into the play details themselves, let’s talk about how to evaluate, cut through the noise, and prioritize the gems. For us, we’ve used a simple framework to evaluate each play before moving ahead and each one in this post is described using the same structure. Using this framework, you will also be able to decide which ones are worth testing in your own firm.

| Element | Purpose |

|---|---|

| Opportunity Size | How much revenue could be generated if this play works. |

| Risk and Reward Snapshot | The upside if it works and what to watch out for. |

| Firm Fit | A quick check to see if your client base, industries, and internal capabilities make this worth pursuing. |

| Ease of Implementation | The relative effort, time, and complexity required to launch it. |

| How It Works | The triggers, AI actions, and outcomes that drive the play. |

| Data and Tools Needed | Split into internal and external requirements so you can assess feasibility. |

| Practical Starting Point | Where to start if you want to run a small pilot. |

| Scaling Tip | How to grow the impact once you have proven it works. |

The framework works best when the plays are clear, actionable, and matched to the firm’s strategy, client base, and data readiness.

Framework and Plays in Action

Below are five AI-powered revenue plays you can adapt. Each one is based on patterns we have seen through client brainstorming sessions, internal debates, and market research.

We present each idea in a visual “card” so you can compare them in a single glance. You can also share these cards with colleagues or decision makers to start a conversation about which ones to try first. This makes it easier to get buy-in and build momentum for AI projects that are directly tied to revenue.

Share them with your team as standalone cards, or keep them together as a playbook.

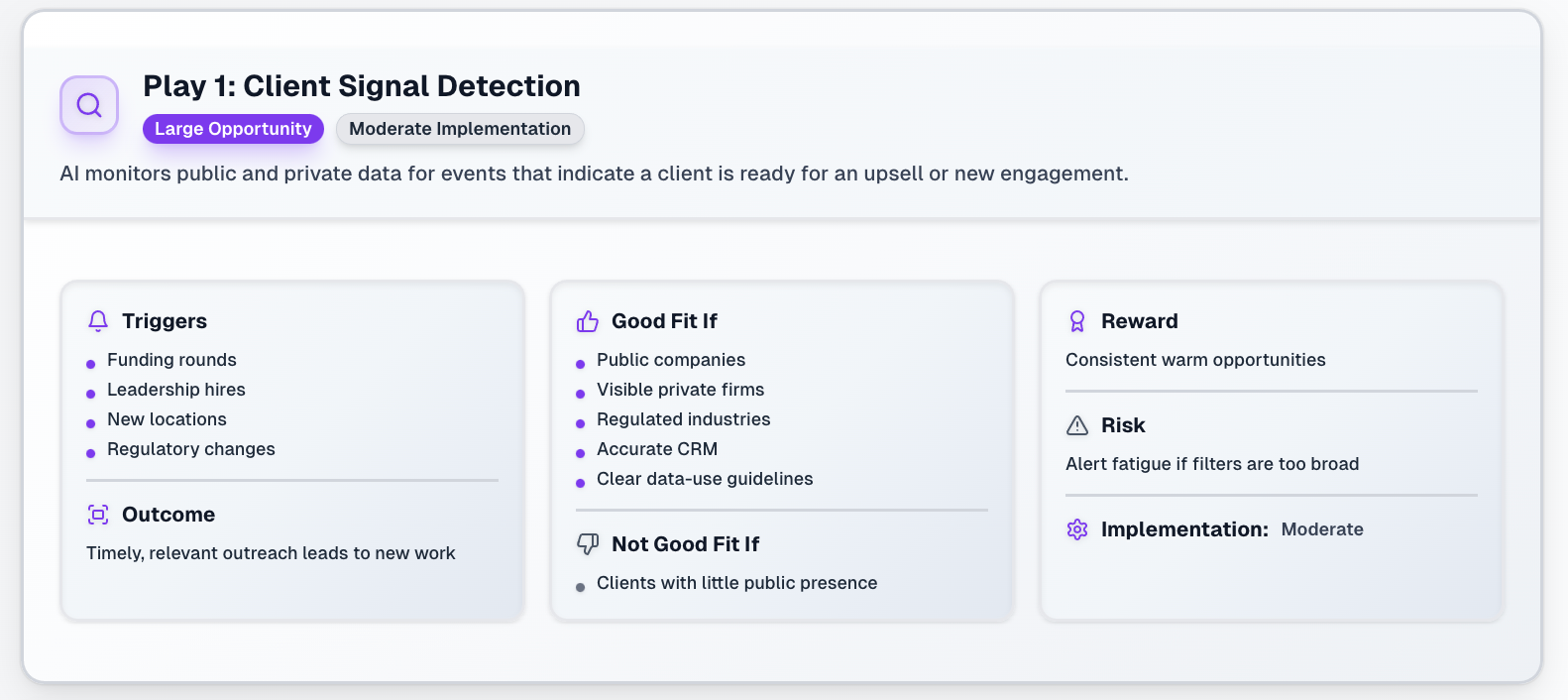

Play #1: Client Signal Detection

Image

AI monitors public and private data for events that indicate a client is ready for an upsell or new engagement.

Opportunity Size

Large Why It Matters

Being first to respond to client changes can win high-margin work and deepen relationships. Ease of Implementation

Moderate. Requires a clean client list and reliable external data sources. Firm Fit

Good Fit if: Client base includes public companies or visible private firms; clients in regulated industries; accurate CRM; clear data-use guidelines.

Not Good Fit if: Most clients have little or no public presence. How It Works

Trigger: Funding, leadership hire, new location, regulatory change.

AI Action: Detects event and alerts partner or BD team.

Revenue Outcome: Timely, relevant outreach leads to new work. Data and Tools Needed

Internal: CRM client list with contact roles; service line mapping to client accounts.

External: News APIs; LinkedIn; SEC/EDGAR; Crunchbase; AI tools for monitoring, event detection, and summarization. Practical Starting Point

Pick one trigger type and one industry segment. Run a small pilot with a few partners. Scaling Tip

Add more triggers over time and include competitor or prospect tracking. Risk and Reward Snapshot

Reward: Consistent warm opportunities.

Risk: Alert fatigue if filters are too broad.

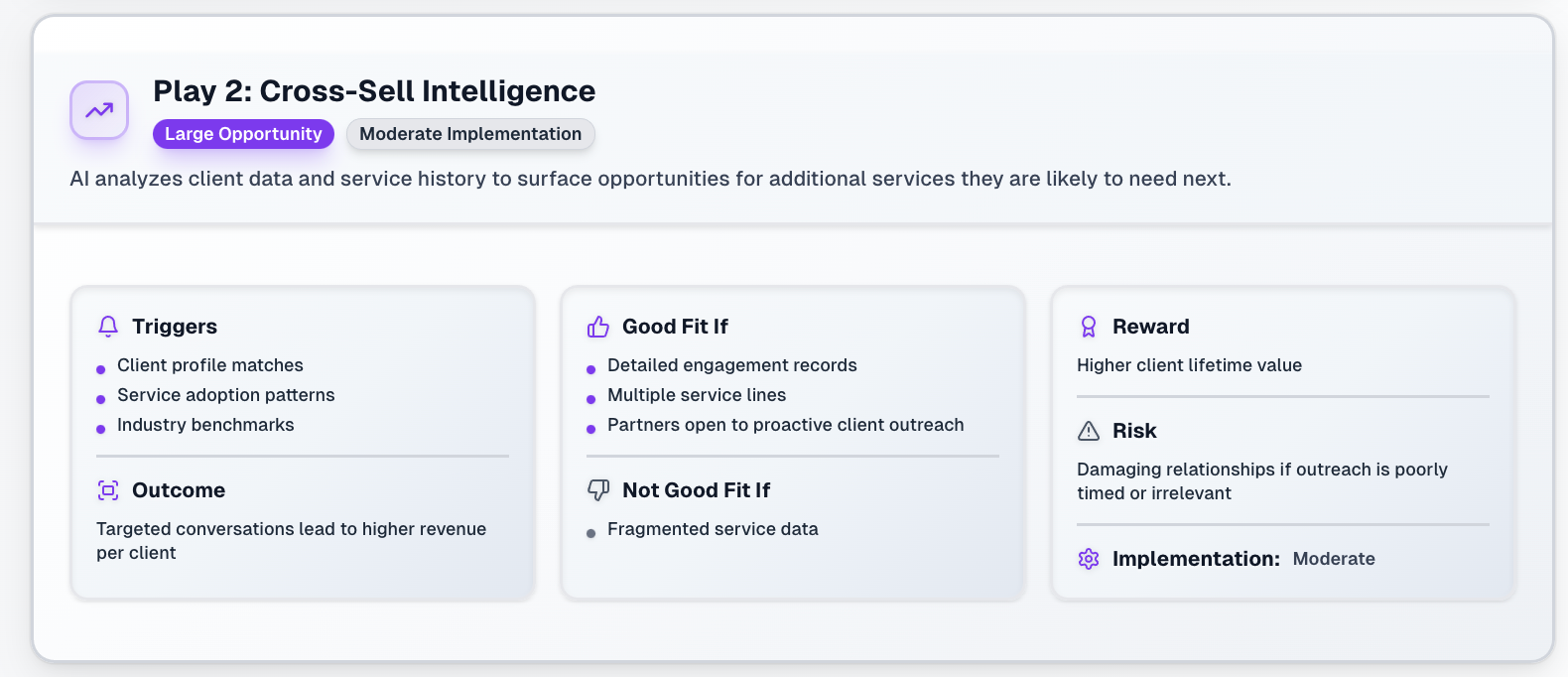

Play #2: Cross-Sell Intelligence

Image

AI analyzes client data and service history to surface opportunities for additional services they are likely to need next.

Opportunity Size

Large Why It Matters

It is easier and cheaper to grow revenue from existing clients than to win new ones. AI helps uncover needs that might not come up in regular conversations. Ease of Implementation

Moderate. Needs structured client service data and clear mapping of which services pair well. Firm Fit

Good Fit if: Firm has detailed engagement records; offers multiple service lines; partners are open to proactive client outreach.

Not Good Fit if: Service data is fragmented or missing. How It Works

Trigger: Client profile matches patterns of other clients who purchased additional services.

AI Action: Identifies potential cross-sell opportunities and flags them for partners.

Revenue Outcome: Targeted conversations lead to higher revenue per client. Data and Tools Needed

Internal: CRM or practice management data with engagement history; service-line pairing matrix; client industry classifications.

External: Benchmark data showing service adoption by similar companies; AI for pattern recognition and matching. Practical Starting Point

Start with one service line and identify clients most likely to need the next logical service. Scaling Tip

Automate opportunity scoring for all clients and integrate into partner dashboards. Risk and Reward Snapshot

Reward: Higher client lifetime value.

Risk: Damaging relationships if outreach is poorly timed or irrelevant.

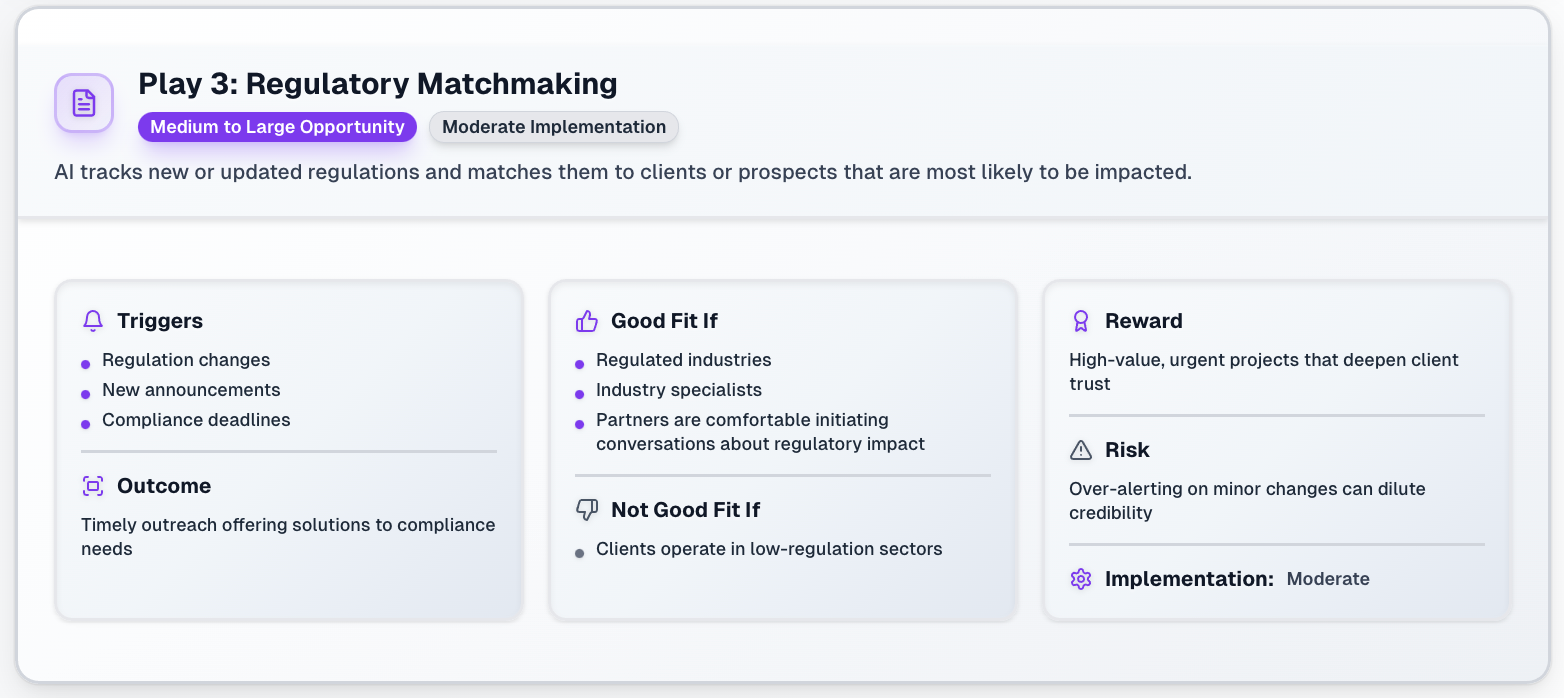

Play #3: Regulatory Matchmaking

Image

AI tracks new or updated regulations and matches them to clients or prospects that are most likely to be impacted.

Opportunity Size

Medium to Large Why It Matters

Regulatory changes often create urgent, high-value work. Being first to alert clients positions the firm as a trusted advisor and can lead directly to new engagements. Ease of Implementation

Moderate. Requires monitoring reliable regulatory sources and linking them to accurate client profiles. Firm Fit

Good Fit if: Clients operate in regulated industries; firm has industry specialists; partners are comfortable initiating conversations about regulatory impact.

Not Good Fit if: Your client base is primarily in low-regulation sectors. How It Works

Trigger: A regulation changes or a new one is announced.

AI Action: Detects the change, identifies affected clients or prospects, and summarizes the impact.

Revenue Outcome: Timely outreach offering solutions to compliance needs. Data and Tools Needed

Internal: Client industry classifications; service line mapping to regulatory expertise.

External: Government regulatory feeds; industry association updates; AI for monitoring, summarization, and impact analysis. Practical Starting Point

Pick one regulatory body or industry to track and test outreach on a small group of clients. Scaling Tip

Add more regulatory sources and integrate alerts into CRM for immediate partner action. Risk and Reward Snapshot

Reward: High-value, urgent projects that deepen client trust.

Risk: Over-alerting on minor changes can dilute credibility.

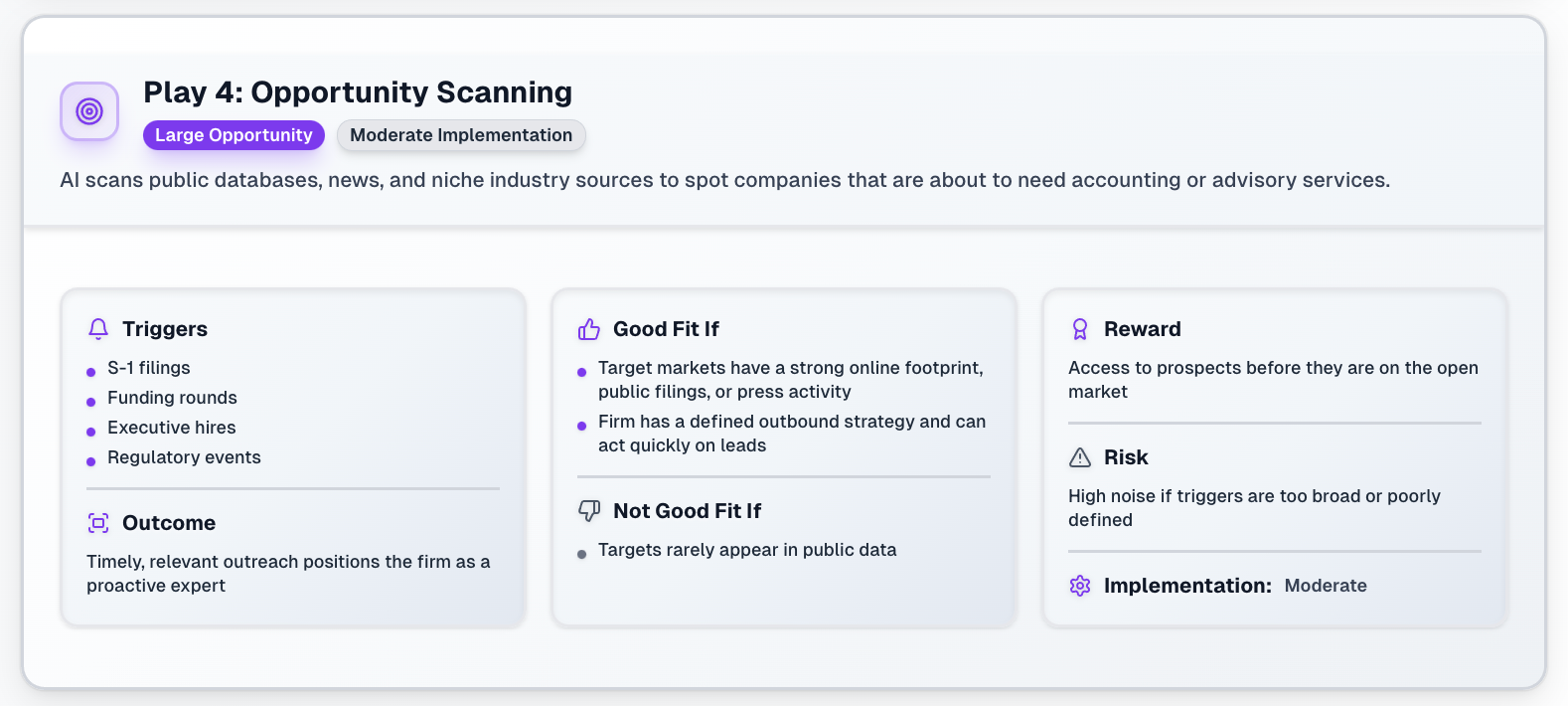

Play #4: Opportunity Scanning

Image

AI scans public databases, news, and niche industry sources to spot companies that are about to need accounting or advisory services.

Opportunity Size

Large Why It Matters

Helps firms find and approach prospects before competitors, often at the exact moment they have budget and urgency. Ease of Implementation

Moderate. Requires clear targeting criteria and automated scanning tools. Firm Fit

Good Fit if: Target markets have a strong online footprint, public filings, or press activity; firm has a defined outbound strategy; team can act quickly on leads.

Not Good Fit if: Target clients rarely appear in public data sources. How It Works

Trigger: Event like an S-1 filing, large funding round, regulatory change, or executive hire.

AI Action: Flags the event, compiles context, and routes to the right partner or BD team.

Revenue Outcome: Timely, relevant outreach positions the firm as a proactive expert. Data and Tools Needed

Internal: List of target sectors and ideal client profile; CRM for lead tracking.

External: SEC/EDGAR; news APIs; industry-specific databases; LinkedIn; AI for event detection and summarization. Practical Starting Point

Choose one trigger type and automate alerts for just that trigger to refine filters and workflows. Scaling Tip

Expand to multiple triggers, add more industries, and integrate with CRM for automated follow-up sequences. Risk and Reward Snapshot

Reward: Access to prospects before they are on the open market.

Risk: High noise if triggers are too broad or poorly defined.

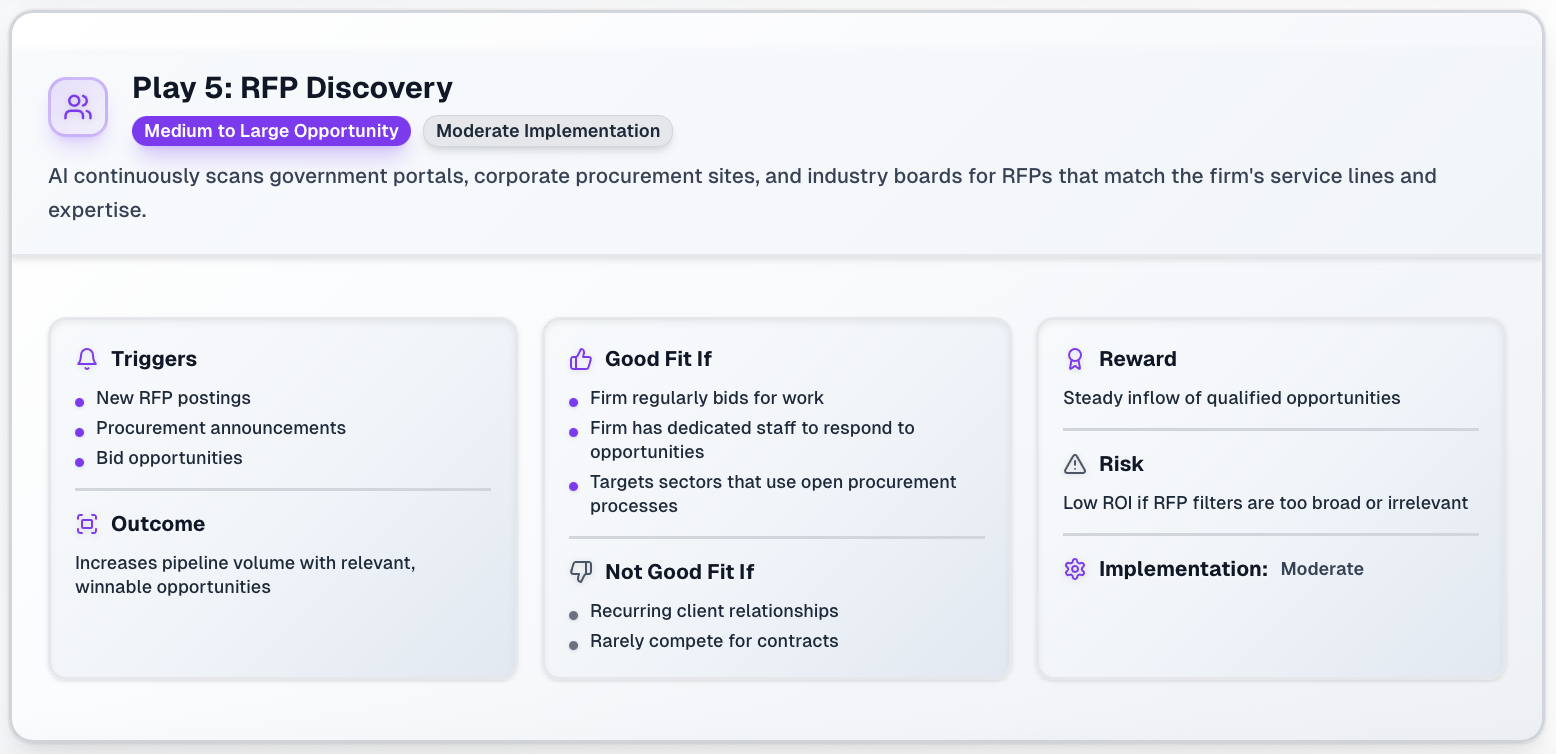

Play #5: RFP Discovery

Image

AI continuously scans government portals, corporate procurement sites, and industry boards for RFPs that match the firm’s service lines and expertise.

Opportunity Size

Medium to Large Why It Matters

Finding the right RFP early increases the chance of winning. AI removes the manual effort of checking dozens of sources. Ease of Implementation

Moderate. Needs well-defined search criteria and integrations with RFP sources. Firm Fit

Good Fit if: The firm regularly bids for work; has dedicated staff or partners to respond to opportunities; targets sectors that use open procurement processes.

Not Good Fit if: Most revenue comes from recurring client relationships and the firm rarely competes for new contracts. How It Works

Trigger: New RFP posted on a relevant site.

AI Action: Identifies the RFP, extracts key details, and scores fit against the firm’s capabilities.

Revenue Outcome: Increases pipeline volume with relevant, winnable opportunities. Data and Tools Needed

Internal: List of target services and industries; proposal templates; win-loss history for scoring.

External: Government RFP portals; corporate procurement boards; industry association sites; AI for document parsing and scoring. Practical Starting Point

Track just one or two RFP sources and test fit-scoring before scaling. Scaling Tip

Automate proposal drafts using historical responses and integrate into CRM for tracking outcomes. Risk and Reward Snapshot

Reward: Steady inflow of qualified opportunities.

Risk: Low ROI if RFP filters are too broad or irrelevant.

Making AI Plays Work in Your Accounting Firm

The best ideas only matter if they are implemented. These AI-powered revenue plays can be game changers, but the way you roll them out will decide their impact. Here’s how to move from reading to doing.

1) Choose the Right Plays

Start with one or two plays that have the strongest fit with your firm’s clients, data, and culture. Focus on those you can implement quickly and that have a high chance of producing measurable results.

2) Define RoI Hypothesis and Success Criteria

Thoughtfully define the hypothesis that describes the hard measures by which value will be assessed. and soft measures by

3) Sequence and Pilot

Run a small pilot instead of trying to roll out everything at once. Pick one industry, one service line, or a single partner group. This lets you refine the triggers, the outreach process, and the success metrics before scaling.

4) Measure ROI Early

Quick wins matter. Measure impact in the pilot phase by looking at metrics such as deals won, proposals sent, and engagements started. Revenue-focused plays are easier to track, so use early results to build momentum and secure buy-in for scaling.

5) Scale and Embed

Once a play is proven, make it part of your firm’s standard business development process. Feed leads into your CRM, surface them in partner dashboards, and add discussion of AI-triggered opportunities to BD meetings. This keeps the momentum going and ensures the plays are not just one-off experiments.

6) Keep Evolving

The triggers, data sources, and AI tools available will keep changing. Revisit your plays quarterly. Look for new data feeds, emerging client needs, or ways to automate more of the process.

Ready to take the next step? We run AI revenue-play workshops for firms that want to adapt these ideas to their own client base and service mix. You can also download the set of shareable play cards from this article to use with your team.