How AI May Transform Accounting Firms Into Service-as-Software Businesses

How AI May Transform Accounting Firms Into Service-as-Software Businesses

The accounting profession stands at a pivotal moment in its evolution. For generations, firms have operated under a professional services model built on billable hours, manual processes, and specialized expertise. Today, artificial intelligence presents an unprecedented opportunity to transform traditional accounting firms into technology-powered Service-as-Software businesses with enhanced economics and valuations.

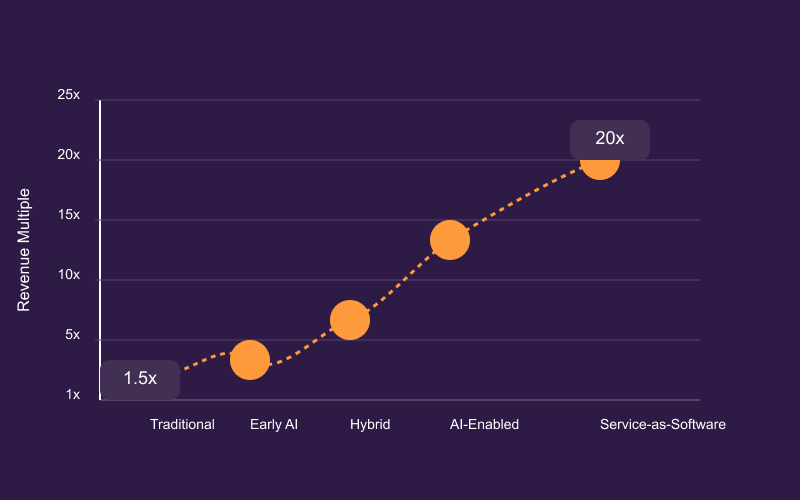

This transformation represents a fundamental shift in how accounting services are delivered, measured, and valued in the marketplace. Firms that successfully navigate this transition could see their valuations increase from traditional 1-2x revenue multiples to levels more commonly associated with tech-driven service providers.

Understanding Service-as-Software

Unlike Software-as-a-Service (SaaS), which delivers standardized software tools via subscription, Service-as-Software transforms traditional professional services by embedding AI to automate expert work while maintaining the customized deliverables and judgment clients expect.

As Foundation Capital notes in their "AI Service as Software" analysis, this AI-driven evolution represents a $4.6 trillion opportunity across industries by automating tasks previously requiring skilled human intervention—a transition that particularly impacts the accounting profession with its structured processes and data-intensive workflows.

Service-as-Software Transformation

The Gold Mine of Audit Data

What makes this transformation possible is a resource that accounting firms already possess in abundance: data. Every audit consists of hundreds of standardized procedures applied across thousands of clients year after year. These engagements generate vast amounts of "exhaust data":

- Workpapers and analytical reports

- Financial statements and footnotes

- Risk assessments and testing procedures

- Client correspondence and documentation

This repository represents a gold mine of training data for AI systems. The repetitive nature of audit procedures across different clients creates perfect patterns for AI to learn from:

- A footnote crafted for one manufacturing client can inform automated generation for similar clients

- An analytical procedure applied to one retail company can be adapted across the entire retail sector

- Risk assessment methodologies can be refined based on thousands of historical engagements

The Economic Crisis in Traditional Accounting

The Deteriorating 33-33-33 Model

Traditionally, accounting firms operated on the "33-33-33 model":

- 33% operating expenses

- 33% staff compensation

- 33% partner profits

This balanced model has deteriorated significantly. Staff compensation now consumes 50-60% or more of revenue due to:

- Increased Complexity: Accounting standards and regulatory requirements have grown more complex, requiring specialized knowledge and time-intensive work

- Declining Productivity: Measured by billable hours per employee, productivity has declined as work-life balance expectations have evolved

- Talent Competition: Competition for accounting talent has intensified, driving up compensation while the supply of new accountants has diminished

The Profit Squeeze

The result is a profit squeeze that threatens the sustainability of traditional accounting business models. Firms find themselves trapped between:

- Client resistance to fee increases

- Economic reality of rising costs

- Declining margins and profitability

AI as the Economic Solution

Dramatic Efficiency Improvements

Artificial intelligence offers a way to break free from this squeeze by fundamentally altering the relationship between headcount and revenue generation.

Example Transformation:

- Traditional audit: 200 hours of professional time

- AI-enhanced audit: 20 hours of human involvement

- Efficiency gain: 90% reduction in labor requirements

This dramatic improvement doesn't just save time—it restructures the entire economics of the business.

Returning to Profitable Models

A firm that can deliver the same high-quality audit with one-tenth of the labor can potentially:

- Return to the historical 33-33-33 model

- Achieve even better economics (20-25% direct labor costs)

- Dramatically improve profit margins

- Increase firm valuations

The Transformation Roadmap

Phase 1: Data Infrastructure Development

Objective: Build systems to aggregate, standardize, and analyze historical engagement data

Key Activities:

- Convert legacy workpapers into structured formats

- Create databases of precedents for AI learning

- Establish data quality and governance protocols

- Build secure, scalable data infrastructure

Phase 2: AI-Powered Workflow Automation

Objective: Develop AI systems that automate routine engagement aspects

Starting Points:

- Clearly defined, repetitive tasks (document review, data extraction)

- Standard calculations and reconciliations

- Template-based deliverable generation

Advanced Applications:

- Risk assessment procedures

- Analytical procedures and trend analysis

- Exception identification and investigation

Phase 3: Subscription Service Development

Objective: Package automation capabilities into subscription offerings

Business Model Shift:

- From purely time-based billing to value-based pricing

- Create recurring revenue streams characteristic of SaaS businesses

- Provide clients with more predictable pricing

- Improve firm cash flow and valuation multiples

Phase 4: Workforce Transformation

Objective: Evolve accountant roles from execution to oversight and advisory

New Role Focus:

- Exception handling and complex problem-solving

- Professional judgment application

- High-value advisory services

- AI system oversight and quality assurance

Required Changes:

- Retraining staff to work alongside AI systems

- Developing new competencies in AI management

- Shifting mindset from hours-based to value-based work

Early Transformation Opportunities

Footnote Generation

Current State: Written from scratch for each client AI-Enhanced State: Automated draft generation based on:

- Historical financial statements analysis

- Natural language processing of precedents

- Industry-specific template adaptation

- Minimal human adjustment required

Footnote Automation

Standard Audit Procedures

Automation Opportunities:

- Confirmation processing: Automated matching and exception identification

- Inventory verification: Computer vision for count validation

- Transaction sampling: Statistical analysis and pattern recognition

- Analytical procedures: Automated variance analysis and investigation

The Competitive Landscape

The Inflection Point

The accounting profession appears to be approaching a critical inflection point. Firms face a choice between:

Traditional Path:

- Continuing with increasingly challenging economics

- Labor-intensive, hours-based billing models

- Declining margins and profitability

- Talent acquisition and retention challenges

Transformation Path:

- AI-enhanced service delivery models

- Value-based pricing and recurring revenue

- Improved margins and economics

- Enhanced firm valuations

Market Positioning

Companies like Tellen that provide AI infrastructure to accounting firms are positioned to enable this transformation. Firms that thoughtfully experiment with these approaches are likely to find themselves better positioned as the industry evolves, with enhanced valuations as markets revalue AI-powered Service-as-Software business models.

Looking Forward

The journey from traditional accounting practice to AI-enhanced service delivery has just begun, but its potential to reshape the profession is substantial. The firms that embrace this transformation early—while thoughtfully managing the transition—will likely emerge as the leaders of the next generation of accounting services.

The question isn't whether this transformation will happen—it's which firms will lead it.

At Tellen, we're building the AI infrastructure that enables accounting firms to make this transition successfully, helping them unlock the economic potential of Service-as-Software business models while maintaining the quality and judgment that clients expect.