How AI-Powered Copilots and Autonomous Agents Will Transform Accounting Firms

We are in a golden age for AI innovation. The convergence of abundant venture capital combined with the surge in groundbreaking entrepreneurial ideas is leading to an unprecedented explosion of innovation. It is against this backdrop that we have launched our business, Tellen AI, which is enterprise AI infrastructure that empowers accounting firms to launch their own generative AI solution.

We believe that the core, user-centric, transformative technology that will emerge from this AI innovation cycle will be generative AI-powered copilots and autonomous agents. Every major accounting firm will install secure and compliant AI infrastructure and will launch copilots and agents to work alongside their team and, eventually, their clients.

The difference between a copilot and an agent is that a copilot operates as an assistant to produce work that is reviewed by a human, while an agent runs autonomously to complete tasks without human input.

Technology #1: Copilots Will Become Accounting Apprentices Accounting is an apprenticeship and for years young accountants have joined the ranks of accounting firms and have learned the ropes from the more seasoned accountants, who have passed down knowledge to the next generation. But recently, things have started to change. The number of college graduates that major in accounting is declining and the average age of accountants is creeping towards retirement age, creating a concerning workforce shortage.

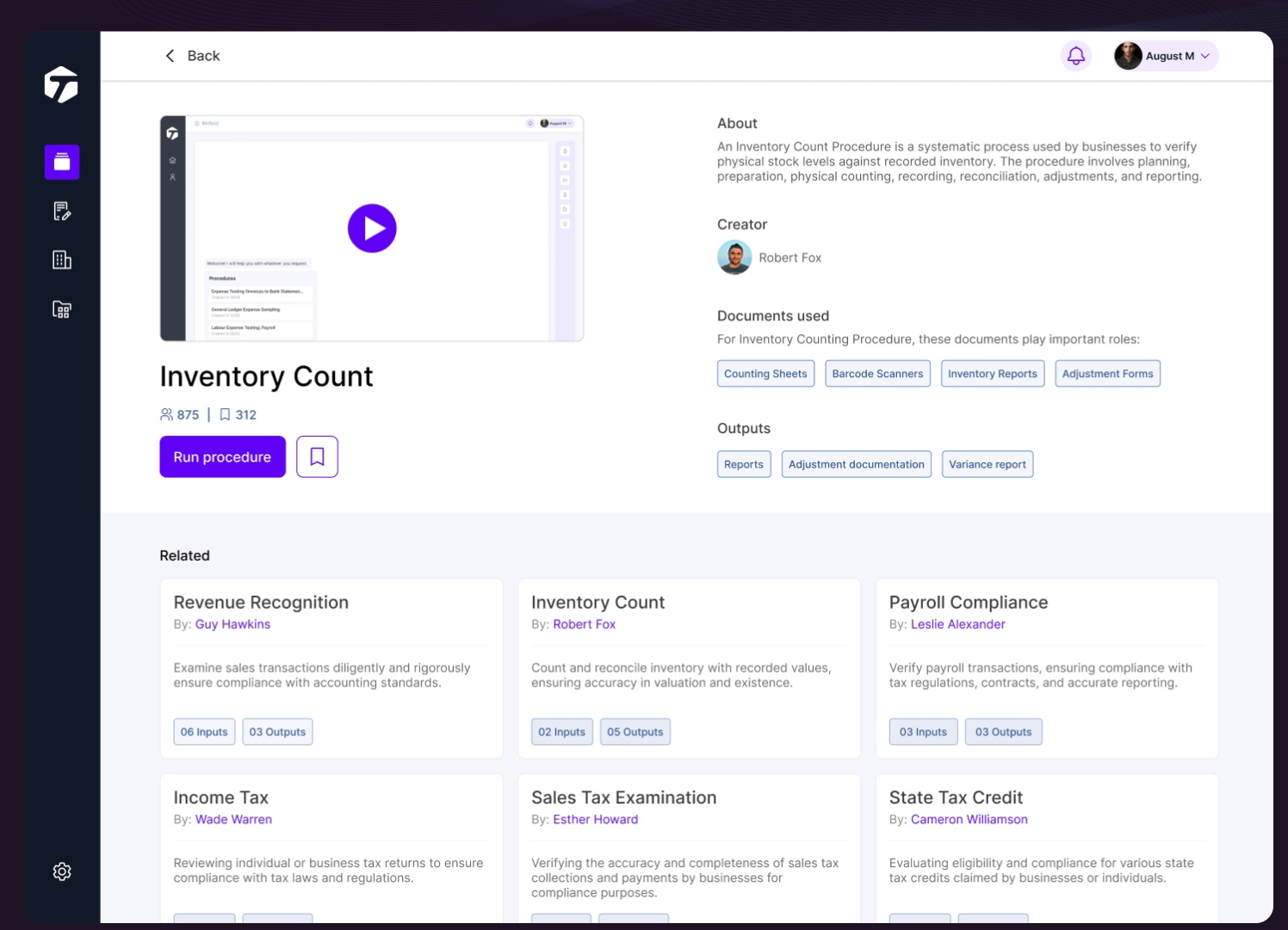

This sets the stage for the AI copilot, which is an AI assistant that produces work that is reviewed and approved by the accountant. Just as seasoned accountants have trained young accountants on how to complete various accounting related procedures, the same thing will happen with copilots.

Each accounting procedure can become an AI application. Using natural language, an accountant will explain the procedure to the copilot, which will learn how to complete it. The copilot will learn from its mistakes each time the accountant reviews a new batch of work, and the copilot’s error rate will drop as more repetitions are completed, much like an apprentice.

Technology #2: Autonomous AI Agents Will Fill The Gaps Through the years, as technology has crept into our lives, we have unwittingly become servants to our technology. For the most part we do not give this any thought since the task takes a short amount of time to complete. For instance, we may look up an address from a website, copy it, and drop it into a maps application in order to find directions. We act as a human connector between the website and the map application.

But wouldn’t it be much better if an AI agent could go to the website, grab the address, drop it into the maps application, and deliver us the directions? We don’t really need a human involved in that workflow. This is the type of task that we can teach AI to do for us, autonomously, without our review or approval at each step. Humans can review the final output while the agent handles the details.

Accountants Will Use Copilots and Agents To Process Data and Adhere to Regulation

The accounting AI space is on the verge of solving two large problems with these two innovative AI solutions. The two problems are compliance adherence and data processing overload. These two problems run deep in the accounting industry. Accountants take pride in compliance adherence and consider themselves expert data wranglers.

Problem #1: Compliance adherence Accounting standards, Audit standards and Tax Codes are incredibly dense, complex, rules and regulations that auditors and accountants must understand and comply with. It is very difficult for an accountant to maintain an in-depth understanding of the entire corpus of accounting regulation. This problem is further exacerbated by the accounting industry workforce shortage. The industry has been forced to promote junior accountants at a faster rate to fill vacant positions, and this results in lower quality adherence to compliance and a rise in the number of deficiencies in the audit process.

Each procedure in an audit process requires a preparer, typically a junior auditor, to complete the procedure and prepare a workpaper that summarizes their work in compliance with the relevant audit standards. Their workpaper is reviewed by more senior accountants, oftentimes there are multiple layers of reviewers before the engagement partner signs off on the workpaper.

This workflow is ideal for an AI copilot. Along every step in the preparer/reviewer workflow, a copilot can review the workpaper, check it against proper regulations, and make suggestions on items to correct. The copilot would not replace the auditors, but rather empower the auditor to produce higher quality work faster.

Problem #2: Data processing overload Too many knowledge workers spend an inordinate amount of time on workflow repetition across applications, websites, and documents. This work is essentially assembly line work where the same process must be applied over and over again. Speed and precision are the most important attributes and knowledge work is not really necessary. In these instances, humans are essentially inserted into data workflows to fill the gaps in between computer processes.

As an example, a 1099-B is a tax form created by an investment broker that itemizes all transactions made by a client during a tax year. A tax accountant collects 1099-Bs from their clients, extracts the data into tabular form, and then imports the data into their tax software in order to ultimately produce the client’s tax return. A tax accountant may be able to process a 1099-B in 20 minutes, but an agent may be able to complete the same workflow in less than 5 minutes allowing the accountant to significantly increase productivity.

Another example is an auditor who must prepare for an audit by compiling all of the required documents from the client. Even if the client uses a system of record that has an easy-to-use export solution, the auditor still needs to export, organize, and open every document to check to make sure that the document is formatted correctly with the necessary data. This process may take 8-10 hours per audit. An audit firm for a given industry may complete hundreds or thousands of audits that use the same software and complete the same audit compilation process. The data processing process happens over and over again, and is an inefficient waste of time for highly skilled auditor knowledge workers.

These data processing workflows can be solved with AI agents that can learn how to complete repetitive multi-step workflows that involve data extraction, organization, and input across websites, emails, documents, and software.

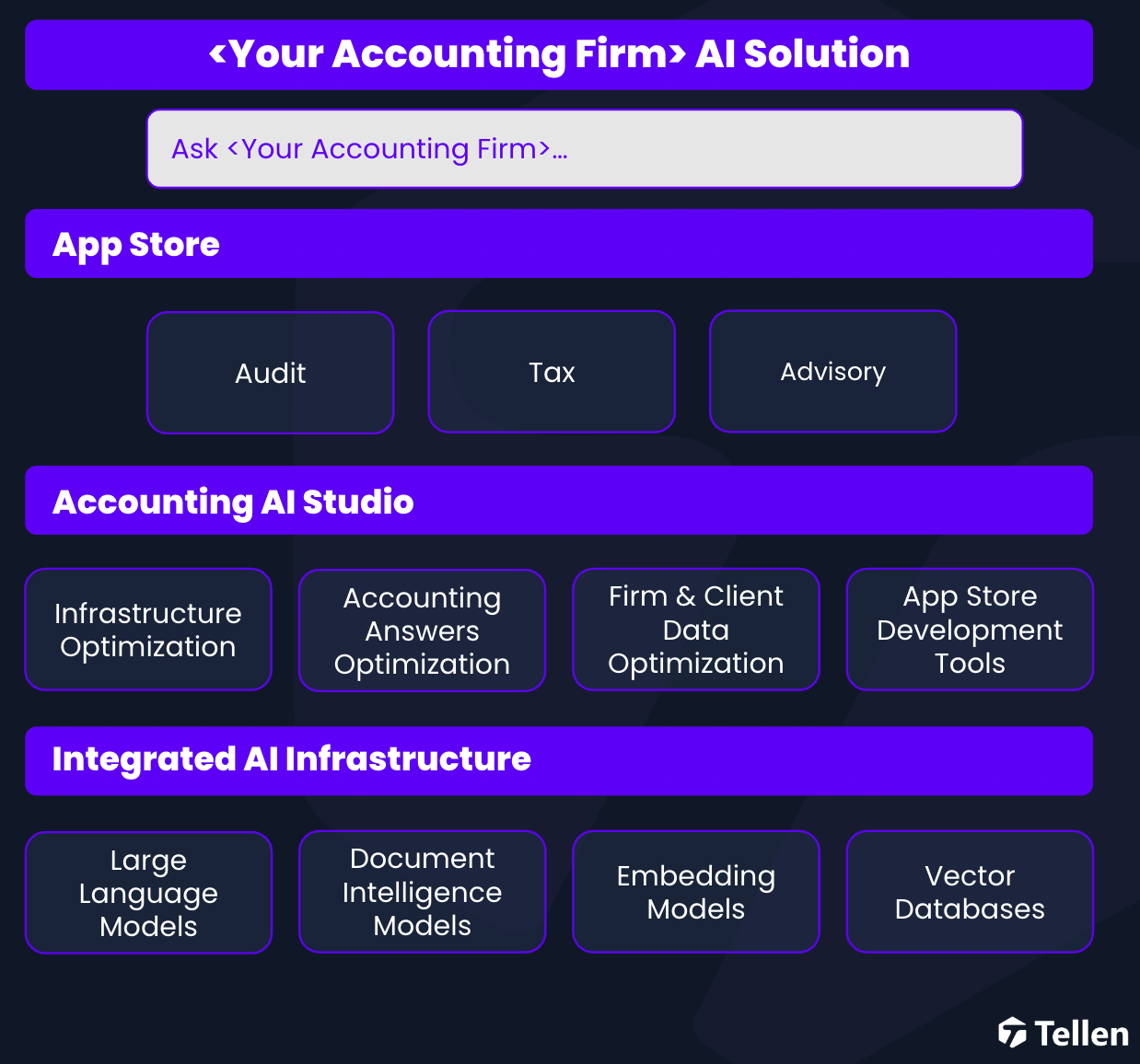

** Tellen’s Accounting AI Studio Powers Accounting Firms with AI Copilots and Agents**

65e140c1654c721789059961__7pByNF4Cbg9HRI20el_gEDzMkSYGqmkKjR9STl_t-hdfwuT9YOG2X0JKONFZC4Eq7RsBIIdSeMiz5nmnMRkYNQ5gauLVfUMkYJo2REznrBCBRKSeuSeONusW8OwXYxNcQ8748Sz4q7U-xAsp7p2BUw.png

Tellen’s Accounting AI Studio is available to accounting firms to take their first step into the world of AI. Accounting firms can use Tellen’s infrastructure to launch their own AI solution for their teams and clients. They will have access to their own AI app store, which will be filled with accounting procedural apps similar to the procedures mentioned in this post. Each app will be designed as a copilot or an agent trained to perform a specific task for the accountant. If the accountant cannot find the app they are looking for, they can create their own app using natural language. Creating new apps is going to become as easy as creating new Excel spreadsheets. Accountants will be able to use their apps for themselves, or share them with their firm so that their colleagues can use the app as well.

For more information about Tellen, or to stay up-to-date on AI for Accounting, we encourage you to join our waitlist and subscribe to our blog. We look forward to embarking on an AI journey with you and your copilots and agents!