The Future of Audit Is Human-Led, AI-Powered

The Future of Audit Is Human-Led, AI-Powered

The future of audit is human-led, AI-powered. That idea captured the spirit of the recent World Continuous Auditing and Reporting Symposium at Rutgers Business School, where regulators, academics, and innovators gathered to explore what comes next for the profession.

Christina Ho, a member of the Public Company Accounting Oversight Board and a self-described data nerd, reminded the audience that auditors are in the “trust” business. Her message was clear. Let’s embrace innovation, let’s evolve, and let’s lead.

For Ho, everything begins with quality structured data. Clean and consistent information is the fuel that produces quality assurance. She explained that the PCAOB’s work in standard setting, combined with the auditor’s role in maintaining trusted financials, will create the foundation for the next generation of AI audit agents that will be reliant on that data.

A standardized taxonomy for audit documentation, she noted, can help smaller firms more easily adopt AI. Third-party vendors can then develop tools that expand access, enabling firms of all sizes to better serve their clients. The goal is not simply automation. It is participation.

Ho also emphasized that regulators should not become anchors that weigh down innovation. She expressed support for an innovation lab where ideas can be tested safely and shared across the profession. Doing nothing, she said, is not a viable option.

Rutgers researchers and doctoral students are already advancing this vision. They are developing agent-based systems, exploring continuous audits, and designing methods for assurance to operate in real-time. The innovations that begin in this academic environment will soon shape the technologies used in practice.

KPMG provided a view into how these ideas are already being applied in the field. Their project aligns directly with the goal of automating audit processes and embedding them within client systems. Built on FastAPI and supported by LangGraph and Langsmith, the architecture organizes its work through a hierarchy of agents.

The Auditor Meta agent functions as a digital twin, guided by an audit taxonomy that determines what must be done and which steps are required. A Planner Agent orchestrates the process, deciding which Action Agents need to be activated. These Action Agents carry out specific audit tasks such as vouching, document classification, data extraction, and input validation. The system also integrates transaction scoring through Mindbridge, assigning risk ratings of red, yellow, or green and providing clear explanations for each score.

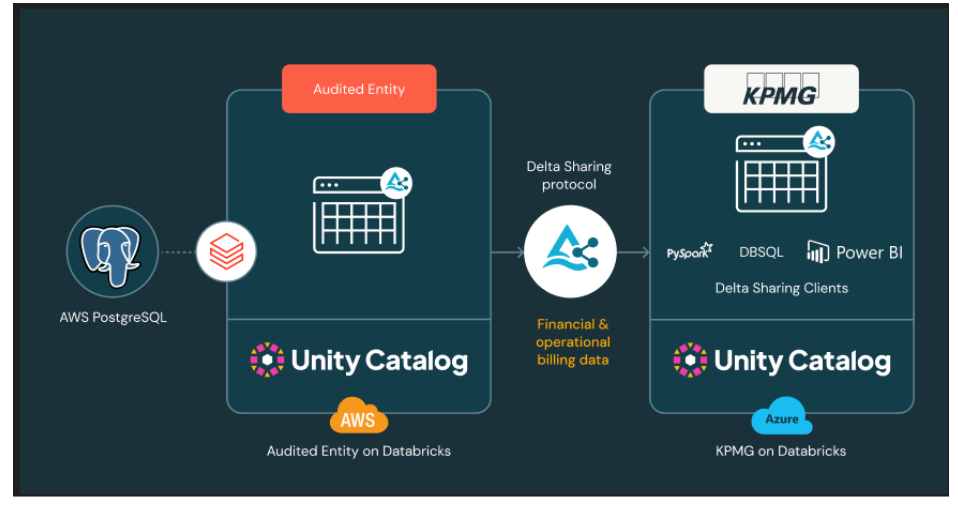

The most significant breakthrough is the system’s integration with the client’s ERP platform. Instead of collecting and moving massive datasets, it uses Delta Sharing to create a secure window into the client’s environment. Data remains within the ERP system, but audit agents can access and analyze it virtually. This replaces traditional collection with what KPMG calls virtual data access.

The architecture connects SAP and Databricks, allowing for data preparation, extraction, and analysis while keeping information secure. Delta Sharing feeds agent groups directly, replacing manual data transfers with automated activation.

KPMG Continuous Audit.png

Some documentation still requires workarounds, such as extraction scripts for journal entries or subledgers, but the foundation is in place for a scalable, low maintenance system. The result is an approach that reduces manual effort, limits data exposure, and enables a continuous audit model. In time, this will extend beyond the audit team to clients themselves, embedding automation in the very systems that generate financial data.

Tellen, in partnership with Citron Cooperman, also presented how mid-sized and large-sized accounting firms that are not Big Four often rely on third-party vendors to roll out AI platforms. Their focus was on improving audit quality. They identified areas where significant time is spent by high-level partners, such as checking for audit binder completeness, and demonstrated how AI can take on those tasks before the quality control review team steps in. This kind of collaboration shows how AI can free up human expertise for more strategic work.

Finally, Pricewaterhouse brought a large client to discuss how they are using AI in the internal audit process. They demonstrated a testing app, called Dynamic Testing, where auditors upload samples and client documents, allowing the AI to test those documents against the samples for internal controls. This real world example highlighted how AI is already streamlining internal audits and making them more efficient.

With a 6% decline in accounting graduates from 2023 to 2024, the message felt timely. The profession needs both new tools and new talent.

At its core, auditing remains guided by integrity and purpose. What is changing are the instruments of trust, and AI is becoming one of them.