Transforming Audit with AI

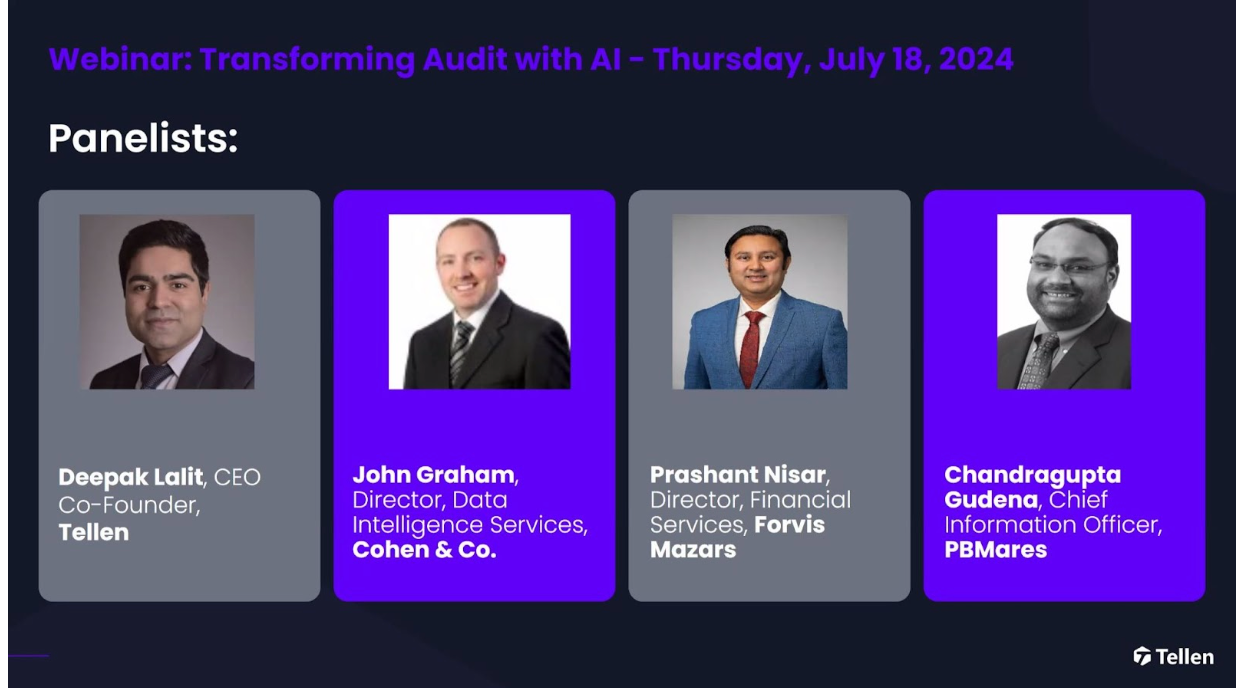

On Thursday, July 18th, Tellen hosted a compelling discussion on 'Transforming Audit with AI,' featuring audit and innovation leaders John Graham of Cohen & Co, Parshant Nisar of Forvis Mazars, and Chandragupta Gudena of PBMares. The session delved into the profound impact of AI on auditing practices and the future of the profession. You can view the recording here.

The Role of AI in Auditing

The webinar began with an exploration of how AI is revolutionizing audit tasks. AI is already being utilized to automate tedious activities such as summarizing meeting minutes, contracts, and financial statements, thereby significantly enhancing audit efficiency. However, the speakers cautioned against over-relying on AI outputs without incorporating professional judgment.

Key takeaway: While AI can handle repetitive tasks efficiently, it’s crucial for auditors to apply their expertise and skepticism to ensure the accuracy and reliability of AI-generated content.

Adoption Across Firms

AI adoption is becoming widespread among audit firms of all sizes, but the Big 4 firms have a head start due to their larger budgets.

Key takeaway: Smaller firms need to be strategic in prioritizing and leveraging AI tools to remain competitive and effective.

Importance of a Secure Digital Core

The importance of having a secure, scalable digital core before deploying generative AI on sensitive client data was a key point of discussion. Proper data classification and vendor risk management are critical to prevent the generation of inaccurate and untruthful AI content, often referred to as "bot shit."

Key takeaway: Ensuring data integrity and security is paramount. Without a solid digital foundation, the risks associated with AI can outweigh the benefits.

The Future of Auditing with AI

The panelists agreed that AI will fundamentally transform the auditing profession by automating routine work and providing real-time insights. However, human expertise and skepticism will remain indispensable, as AI can produce unreliable content if not properly validated.

Key takeaway: AI is a powerful tool that will reshape auditing. Yet, the role of the auditor in applying judgment and ensuring the accuracy of AI outputs is more important than ever.

The webinar highlighted that while AI offers tremendous potential to enhance audit efficiency and insight, the need for professional oversight and secure data management practices is crucial to fully realize its benefits.