The Deeper Trends in the Rise in PCAOB Audit Deficiency Rates

Recent trends in audit deficiency findings by the Public Company Accounting Oversight Board (PCAOB) indicate a rising concern over audit quality. The PCAOB reported an increase in audit deficiencies, with approximately 40% of all audits reviewed in 2022 having one or more significant deficiencies. This rate has increased from 34% in 2021 and 29% in 2020. The rise in deficiencies is considered unacceptable by the PCAOB, prompting calls for firms to improve their audit practices to better protect investors.

A significant number of deficiencies identified by the PCAOB are recurring issues that have persisted over multiple years. This indicates that some firms are struggling to address root causes of audit quality problems. The PCAOB is planning to evaluate the culture within large audit firms to understand how it may impact audit quality. This initiative will involve interviewing firm personnel and reviewing documentation to gain insights into how cultural factors influence audit outcomes. Overall, these trends highlight the need for audit firms to continually enhance their audit processes and address both new and recurring deficiencies to ensure they meet PCAOB standards and investor expectations.

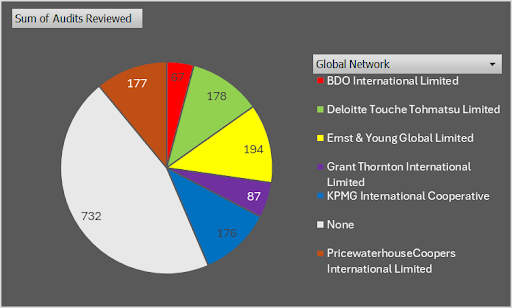

We dove into the data to see where many deficiencies are being found in the past few years of inspections. We first looked at the data for the largest global networks as included in the PCAOB’s reports, noting that across most firms this trend seems to be consistent (note that only approximately half of the audit reports expected for Inspection Year 2023 have so far been released).

First, we noted that in the past three audit years, just over half of the audits reviewed by the PCAOB were associated with the global networks of the Big Four firms, plus BDO and Grant Thornton.

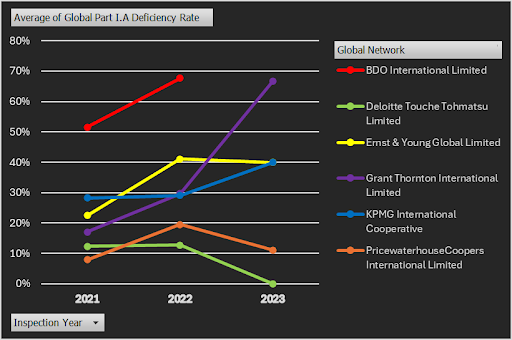

P2.png

Of those large firms, EY and KPMG were largely in line with the wider deficiency findings rate, and the trend of recent increase in these findings. Meanwhile, Deloitte and PwC reflected Part I.A deficiency rates much lower than the larger population. Finally, while no data has been released for BDO thus far for 2023, they, along with Grant Thornton seem to be experiencing a findings rate above that of the population of all firms and has been increasing.

P3.png

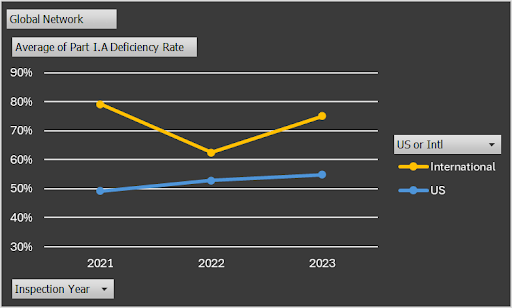

We also wanted to investigate the rate of findings in smaller firms not listed as part of these global networks. We noted that for these firms, the average rate of Part I.A deficiency findings was 52.9%, 53.9% and 56.0% in inspection years 2021, 2022 and 2023 respectively.

While smaller firms were driving the increase in the rate of Part I.A findings, the largest global networks, while generally better resourced, are not immune to the wider trend of increased findings. Within these smaller firms however, we analyzed how the findings rates of U.S. based firms compare to the global average. Smaller firms based in the U.S. experienced an average findings rate of 49.2%, 52.9% and 54.9% in inspection years 2021, 2022 and 2023 respectively, slightly below the overall findings rate for smaller firms more broadly but above the overall average across each inspection year.

P4.png

While firms may be quick to look at these data and conclude that the increase in Part I.A finding rates by the PCAOB has been driven by one source or another, our analyses have found that the trend can be found within all subgroups. Notably, in 2022, the last full year of data available, findings rates approached one another for US and international firms. While international firms, particularly those not part of a global network may incur findings at a significantly higher rate than the overall average, smaller U.S. firms are also incurring higher rates of findings.

Across the board, through the subset of reports released for inspection year 2023, rates of part I.A findings show no signs of decreasing, with around 50% of audits overall being issued a finding. Firms, already resource constrained whether large or small, need to consider alternative approaches to audit quality if the PCAOB’s stated goal of reducing inspection findings is to be achieved.