What an AI-Enabled Audit Looks Like

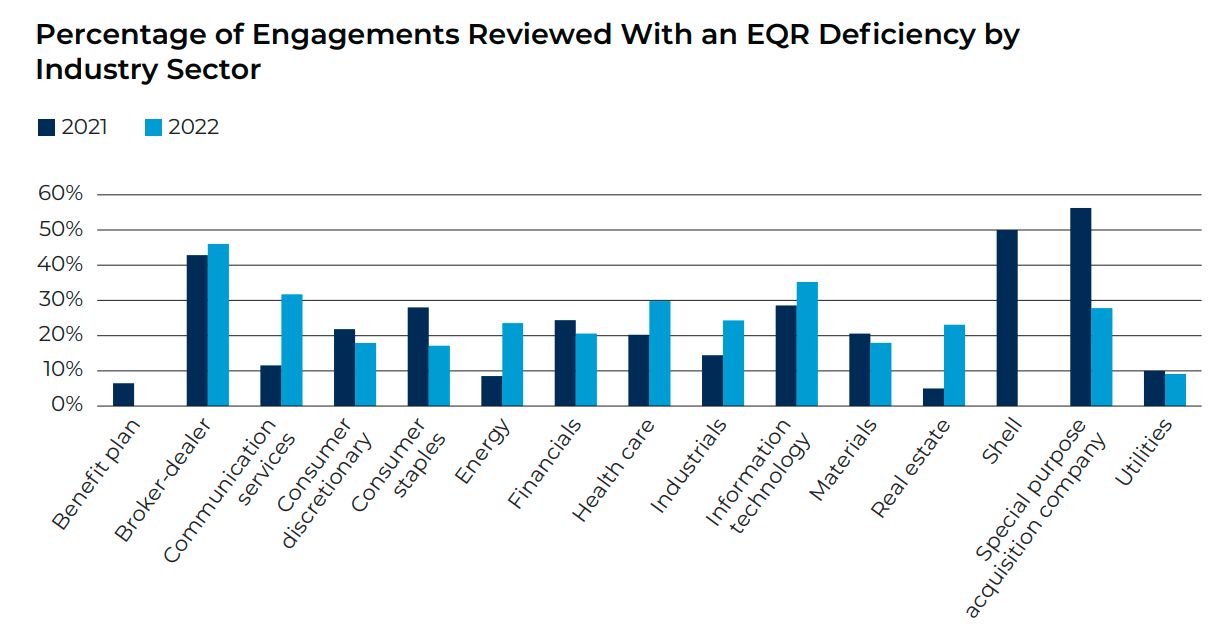

At Tellen, we’re developing the tools we believe will enable auditors to maximize the potential of AI in their workflows. To accomplish this task, we’ve undertaken numerous product research calls and gathered some surprising (and some expected) findings along the way. We’ve also kept a close eye on what is being said about AI in the industry, given it has been perhaps the hottest topic for the past year. In the first part of this series, we’ve examined how auditors perceive the impact of AI since ChatGPT first gained mainstream notoriety and we’ve also explored what industry leaders are saying about AI, at least publicly. With the exciting announcement that Tellen has reached agreements with our first three design partner firms, we wanted to dive a bit more into how the tools we’re building will deliver the AI enhanced audits.

66150012f2b4b2d542d62756_D3MofWLmBDN0x3Ekj-ODFx78S0fBo_fiaWHEkyFSKVsGNQkIK51FThcwQEH2z2lnxPS7l595Ant66XiORjSf9NOgrlyFKWHpLfdORLhQkG60_oq-DD9RCYmH_4iU3QNJZGR_l0EztRO2SD06mqUeSww.png

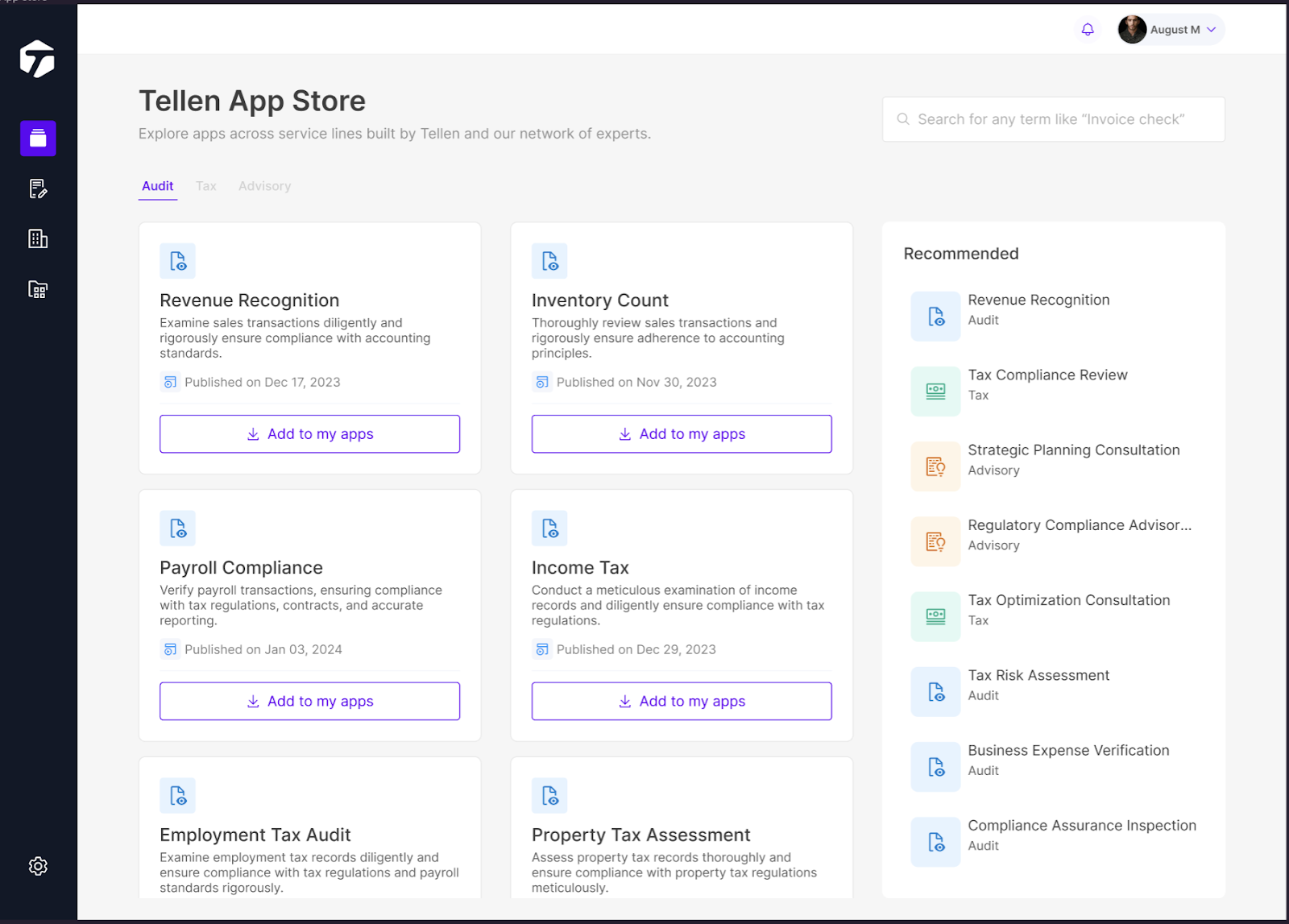

We believe we have developed the foundations of a tool that can perform certain audit procedures and we’re excited to work with our design partners to further develop its potential. For example, our invoice to bank statement tool can perform basic vouching and tracing across both documents. Auditors who currently spend most of their time preparing could take on the role of a reviewer, confirming the conclusions reached by the AI are appropriate. Further, just like human junior and staff auditors, AI won’t be able to match everything the first time. In some instances, the tool will flag a result where further information is necessary to confirm whether or not an attribute has been satisfied. As in existing audit procedures, evidence may not neatly tie to accounting records but requires aggregation or other reconciling items to perform the procedure. We anticipate that this arrangement will assist staff in becoming more adept at problem solving while the AI prepares the subset of transactions in the testing sample that are more straightforward.

Our AI tools can also read, interpret and summarize large volumes of technical writing and data for the use of the audit team. Currently, audits in certain industries such as real estate incur significant time and expense reviewing large numbers of contracts. Our contract analyzer app will assist auditors in their review of these contracts by identifying and extracting key terms and proposing accounting treatment for contracts with customers across all industries.

6716b8a7cfa24d6d262885ff_66150bd503aa8c469645f9bc_Screenshot%202024-04-09%205.34.59%20AM.png

AI to Enhance Audit Quality

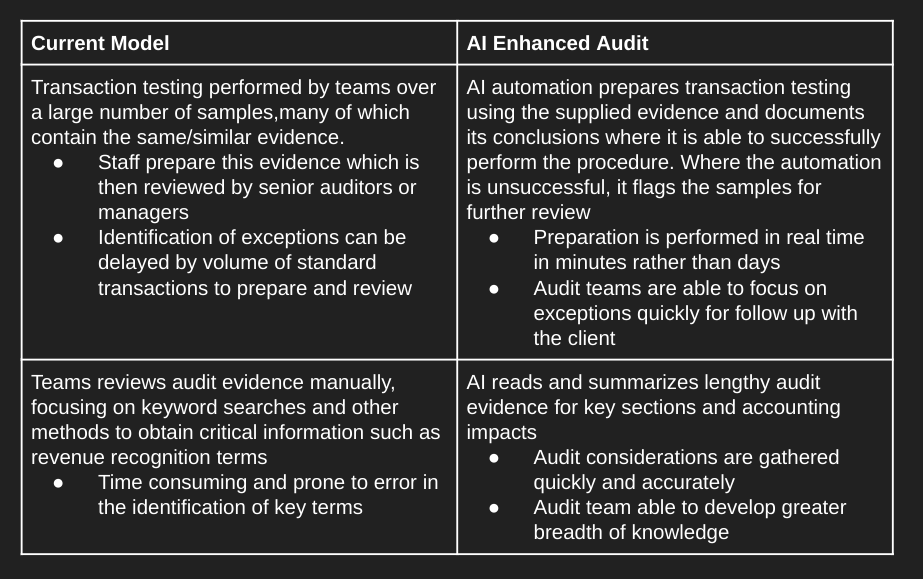

Another broad implication of AI in the audit is the impact it can have on audit quality and this is one we’re just as excited about. As we’ve learned, despite the time and expense spent on audits of the US’ largest companies, the results when inspected by the PCAOB are often poor and have not been trending positively in recent years. Even those audits engaging highly experienced and skilled Engagement Quality Reviewers have not been immune to the recent trend in rising deficiency findings.

6615001249b35fd62407d26c_9GeE_5QN8lJ3qfVzVdoAIgu9aoycMAMTAIyCzKS5CUxnwJGvBhtCo-PPUKSJtPrcEBpW4JI7BWgRXToPLckwCBJD5cgBg6Tyabk5xCqMfRKZz711C7Q3rWIbUP9Ph2TxIvIU-pgxpAzgH8-66bF8raI.png

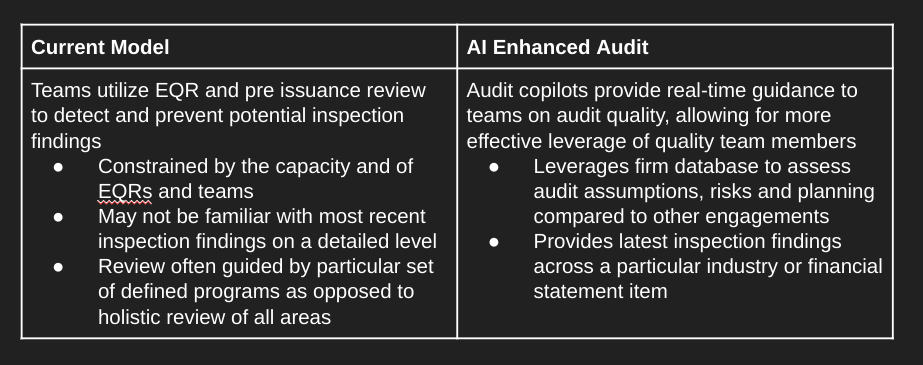

We anticipate that AI has a role to play in the audit quality and peer review space. Currently, audits of large, publicly listed companies engage EQRs and some are also strategically chosen for pre-issuance review with internal quality teams, hoping to detect and prevent findings that may arise in a PCAOB inspection. Both of these reviews, costly in their own right, are also limited by the capacities of the reviewers. We anticipate a generative AI that could perform certain internal quality reviews, working in the background while auditors complete their procedures. With this tool, all audits, even those without EQRs and those not chosen for pre issuance review, will have the capability of leveraging the firm’s data to spot inconsistencies and potential findings. Finally, we aim for the tool to have the capability to leverage the latest results of inspections from the PCAOB and further apply these findings to the applicable sections of the audit.

6716b8a8cfa24d6d2628860e_66150c99d71c90fb92baaf8b_Screenshot%202024-04-09%205.38.18%20AM.png

We believe AI has the capability to make audits not only more efficient but also significantly more effective, ensuring confidence in the financial statements issued to markets. The apps we are building will allow firms to achieve new levels of productivity and deliver the quality their clients are seeking. To learn more about Tellen, reach out to us via the contact links on our home page.