How Private Equity Uses APS to Acquire US Accounting Firms

Over the past four years, private equity has surged into the United States accounting profession, reshaping it at a pace the industry has never seen. What was once a slow-moving, partner-driven ecosystem has become a battleground for capital, acquisitions, and technology transformation. The enabler and the flashpoint is the Alternative Practice Structure (“APS”).

The APS model for CPA firms is the legal architecture that makes private equity mergers and acquisitions possible in the accounting industry. Without it, independence rules under the AICPA Code of Professional Conduct, PCAOB standards, and state boards would block outside ownership of CPA firms. With it, private equity can buy into the majority of a firm’s revenue stream.

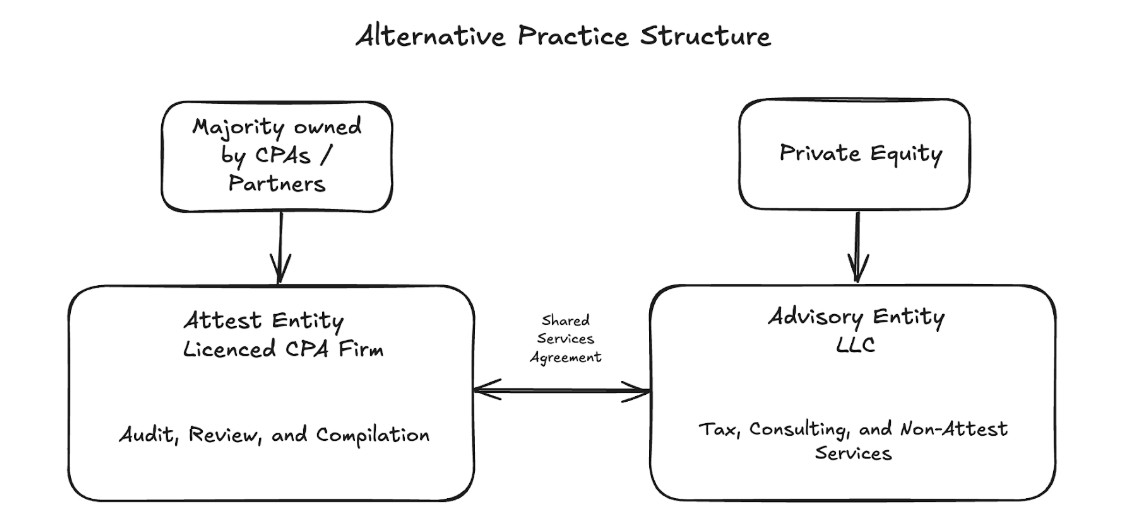

The model works by splitting a firm into two. The attest entity, the licensed CPA firm, handles all audit, review, and compilation work, remaining majority-owned by CPAs. The advisory entity, often an LLC, delivers tax, consulting, and all non-attest services. This is the entity private equity buys into. The two operate under a shared services agreement, which allows them to share a brand and a technology stack, coordinate marketing, and present a unified face to clients while remaining legally distinct.

Alternative Practice Structure.png

From the investor’s perspective, APS is a compliant way to own the parts of the business with the highest margins and growth potential. From the firm’s perspective, it is a way to unlock liquidity, access capital for acquisitions and technology, and solve succession planning without relying on the next generation of partners to buy in.

Why Private Equity Loves the Alternative Practice Structure for Accounting Firm Acquisitions

The APS model is a private equity deal structure in accounting that allows investors to own and scale the high-margin, recurring revenue parts of the business while leaving the regulated audit business in CPA hands. It enables them to fund acquisitions, technology upgrades, and national expansion, all while avoiding regulatory breaches. It also gives them the flexibility to integrate acquisitions quickly because the advisory business is not bound by the same ownership rules as the attest entity.

Why Firms Say Yes to APS

For accounting firm partners, APS delivers three benefits that traditional internal succession rarely can.

- First, it provides immediate liquidity, often at attractive valuations (ie, nine and twelve times EBITDA for larger firms), rather than years of incremental buyout payments.

- Second, it provides growth capital for mergers and acquisitions, AI-enabled technology transformation, marketing, and offshore delivery centers.

- Third, it solves the challenge of succession planning without requiring the next generation to take on significant financial commitments.

The Risks Lurking Under the Surface For Private Equity in Accounting Firms

APS solves the capital problem, but it creates new challenges.

Two separate entities with two different ownership and governance structures can create cultural divergence. The audit side operates under regulatory constraints and public interest obligations, while the advisory side answers to investors with expectations for growth, efficiency, and margins.

Regulatory scrutiny is already present. The SEC and PCAOB have expressed concerns that investor influence could indirectly compromise audit quality. Any high-profile audit failure in a PE-backed firm could bring stronger oversight and stricter rules.

There is also exit uncertainty. Private equity funds eventually sell, and the next buyer could be another fund, a strategic acquirer, or even a public company, each with its own strategic priorities.

Finally, running two entities with separate legal requirements and financial records adds operational complexity that demands ongoing compliance vigilance.

Our Take: APS Is a Transitional Model

APS is not likely to be the permanent structure for private equity involvement in accounting. It is a bridge between the traditional partnership model, where CPAs owned 100% of the firm, and a possible future where non-CPA ownership of audit firms is allowed.

In the meantime, APS is fueling an unprecedented wave of capital inflow, firm consolidation, and technology modernization. It is also changing what it means to be a partner, from owner-operator to shareholder in a growth company with private equity backing.

The Opening of the Door: APS and the First Wave of Deals

The modern wave of private equity in accounting began in August 2021, when TowerBrook Capital Partners invested in EisnerAmper’s newly created advisory entity. This was the first major United States firm to adopt APS, and it provided the regulatory and legal blueprint for every major PE deal since. By carving out the attest practice into a separate CPA-owned entity and placing the advisory and consulting businesses into a new LLC, EisnerAmper showed that large-scale outside investment in accounting could be both compliant and scalable.

What followed was a series of high-profile transactions that accelerated the industry’s transformation.

*APS Transactions and Major Mergers (2021–2025)

| Date | Investor/Entity | Target Firm | Transaction Details | Notes |

|---|---|---|---|---|

| Aug 2021 | TowerBrook Capital Partners | EisnerAmper | APS advisory carve-out | First large-scale APS deal in the USA |

| Sep 2021 | Lightyear Capital | Schellman | Cybersecurity audit and compliance investment | |

| Oct 2021 | New Mountain Capital | Citrin Cooperman | Majority stake acquisition | |

| Jun 2022 | Parthenon Capital | Cherry Bekaert | Investment | |

| Feb 2024 | Hellman & Friedman, Valeas Capital Partners | Baker Tilly | Minority investment | |

| Feb 2024 | Baker Tilly & Moss Adams | Merger | Creates sixth largest U.S. accounting firm (> $3B revenue) | |

| Mar 2024 | New Mountain Capital | Grant Thornton Advisors LLC | Advisory carve-out from LLP, majority stake acquisition | |

| Jul 2024 | Charlesbank Capital Partners | Aprio | Investment | |

| Oct 2024 | Further Global Capital Management | Armanino | Minority stake (~20%) | |

| Nov 2024 | Investcorp, PSP Investments | PKF O’Connor Davies | Investment | |

| Nov 2024 | Centerbridge Partners, Bessemer Venture Partners | Carr, Riggs & Ingram | Investment | |

| Jan 2025 | Blackstone | Citrin Cooperman | Significant secondary stake from New Mountain Capital | Combined ownership exceeds two-thirds |

| Feb 2025 | Apax Funds | CohnReznick | Investment | |

| Aug 2025 | New Mountain Capital | Wipfli | Significant minority stake using APS structure |

The Current State: The Mid-Tier Accounting Firm Consolidation

While consolidation began as the domain of large Top 20 firms, the gravitational pull of private equity has already started shifting. In 2024 and the first half of 2025, the action has increasingly moved into the mid-tier, firms ranked roughly 25 to 300 in size, and the pace has been extraordinary. These firms are large enough to serve as credible regional or niche platforms, but small enough to be acquired at valuations that allow for margin expansion and eventual resale.

Private equity deal structures in accounting utilize APS to buy these mid-tier platforms, bolt on smaller practices, and eventually sell them to larger national APS platforms or recapitalize with bigger funds. For many of these firms, the allure is the same as for their larger peers, a capital partner to modernize technology, scale services, and solve succession without relying on traditional partner buyouts.

The year 2024 was the busiest M&A year of the current cycle, and the mid-market was the most active segment. So far, 2025 is on pace to beat 2024 in terms of the record number of transactions completed. Dozens of acquisitions in the ten million to fifty million dollar revenue range have closed, most of them tuck-ins for existing PE-backed APS platforms. The drivers are clear. APS is now a familiar, regulator-tested model. Many mid-tier firms have aging leadership and no clear internal succession plan. Private equity funds are under pressure to put money to work in stable, cash-generating industries.

Multiples and Expectations

At the top end, large APS platforms still trade in the low double digits on EBITDA, roughly ten to twelve times for high-quality firms with strong brands, scalable operations, and a technology roadmap. Blackstone’s 2025 secondary investment in Citrin Cooperman and New Mountain’s 2024 deal for Grant Thornton confirmed that range.

In the mid-tier, multiples are more restrained, often in the mid to high single digits. Many of these deals include rollover equity, earnouts, and contingent consideration, meaning the true cash multiple is often lower than the headline number.

While seller expectations rose in early 2024 as financing conditions improved, average multiples did not expand meaningfully. More deals closed because the bid-ask gap narrowed and credit markets became more active, not because buyers were paying more.

List of United States Private Equity Deals in Accounting (2021-2025)

The following table lists every publicly announced United States PE-backed accounting deal since 2021. Mid-tier firms are shown in italics.

| Firm | PE Investor(s) | Stake Type | Structure | Announced | Notes |

|---|---|---|---|---|---|

| EisnerAmper (Eisner Advisory Group) | TowerBrook Capital Partners | Undisclosed | APS | 2021-08-02 | First Top 20 firm to take PE stake under APS model |

| Schellman | Lightyear Capital | Undisclosed | APS | 2021-09-17 | Cybersecurity-focused APS |

| Citrin Cooperman | New Mountain Capital | Majority | APS | 2021-10 | Platform investment |

| Cherry Bekaert (Advisory practices) | Parthenon Capital | Undisclosed, advisory only | APS | 2022-06-30 | Advisory-focused APS |

| Grant Thornton US (Grant Thornton Advisors LLC) | New Mountain Capital | Majority in non-attest | APS | 2024-03-15 | Large platform deal |

| Baker Tilly (Advisory Group, LP) | Hellman & Friedman, Valeas Capital Partners | Minority | APS | 2024-02-05 | Large minority PE investment |

| Aprio | Charlesbank Capital Partners | Undisclosed, minority implied | APS | 2024-07-11 | First institutional capital partner |

| Armanino | Further Global Capital Management | Minority (~20% per media) | APS | 2024-10-18 | Top 20 firm |

| PKF O’Connor Davies | Investcorp, PSP Investments | Undisclosed, growth investment | APS | 2024-11-18 | Growth platform for roll ups |

| Carr, Riggs & Ingram (CRI) | Centerbridge Partners, Bessemer Venture Partners | Undisclosed, growth investment | APS | 2024-11-18 | Regional platform |

| Citrin Cooperman | Blackstone (secondary from New Mountain Capital) | Significant | APS | 2025-01-07 | Secondary investment |

| CohnReznick (non-attest business) | Apax Funds | Undisclosed | APS | 2025-02-26 | First institutional capital partner |

What Comes Next

The next two years will likely bring more deals, but smaller ones on average. Add-ons will dominate as PE-backed platforms densify their regional coverage and add specialized service lines. This will keep transaction volume high, but average deal size lower than the peak seen in 2024.

Integration will be the real challenge. APS platforms now own dozens of distinct legal entities, each with its own systems, culture, and pricing. The winners will be those who can standardize delivery, improve margins, and maintain the independence safeguards that make APS compliant.

Regulatory scrutiny will remain constant. The SEC and PCAOB have made it clear that they are watching APS closely. A high-profile audit misstep could accelerate calls for tighter guardrails.

For mid-tier firms, the opportunity is clear. Capital from private equity can fund technology modernization, expand service offerings, and solve succession challenges in ways that traditional partner buyouts cannot match. However, these benefits come with trade-offs, most notably, the loss of complete control and the demands of aligning with a larger platform’s strategic priorities.

If you are a firm operator considering this path, now is the time to prepare. Ensure your financials are clean, sharpen your market positioning, and have a straightforward integration narrative. In a competitive and accelerating market, readiness will determine whether you attract the right buyer on the right terms or are left reacting after competitors in your region have already made their move.

Frequently Asked Questions About the Alternative Practice Structure and Private Equity in U.S. Accounting

1. What exactly is the Alternative Practice Structure (APS)?

APS is a legal framework that allows private equity to invest in accounting firms while complying with ownership restrictions on CPA firms. It works by splitting the business into two entities: the CPA-owned attest entity for audit, review, and compilation services, and the privately owned advisory entity for tax, consulting, and other non-attest services.

2. Why do private equity firms prefer APS?

APS gives investors access to the high-margin, scalable parts of the business, such as advisory and consulting, as well as tax, while avoiding restrictions on audit ownership. It also allows for faster integration of acquisitions, access to recurring revenue streams, and opportunities to scale through technology and service expansion.

3. What is the main appeal of APS for accounting firm partners?

It provides immediate liquidity, often at higher valuations than internal buyouts, along with growth capital for technology upgrades, acquisitions, and expansion. It also addresses succession challenges without requiring the next generation of partners to finance a buy-in.

4. What risks come with adopting APS?

Firms face cultural differences between the audit and advisory entities, heightened regulatory scrutiny from the SEC and PCAOB, operational complexity from managing two separate legal structures, and uncertainty about the following ownership change when the private equity fund exits.

5. How active is the current APS market?

Activity is at record levels, with large national firms and mid-tier firms both involved. The market is shifting toward more add-on deals as platforms expand regionally and build specialized service lines.

6. What multiples are typical in APS transactions?

Top-tier firms often trade between 10–12 times EBITDA, while mid-tier firms see mid-to-high single-digit multiples. Deal terms often include rollover equity, earnouts, or contingent payments that can affect the cash multiple.

7. How long do private equity firms typically hold their investments?

Most private equity funds operate on a 4–7 year horizon before selling or recapitalizing, which means firm ownership may change again within that timeframe.

8. What should a firm do to prepare for a potential APS transaction?

Clean and audit your financials, clarify your market niche, address leadership succession, and create a clear integration plan. Buyers look for firms that can be efficiently absorbed into a larger platform without operational or cultural disruption.