PCAOB Reports Another Rise in Part I.A Deficiency Findings

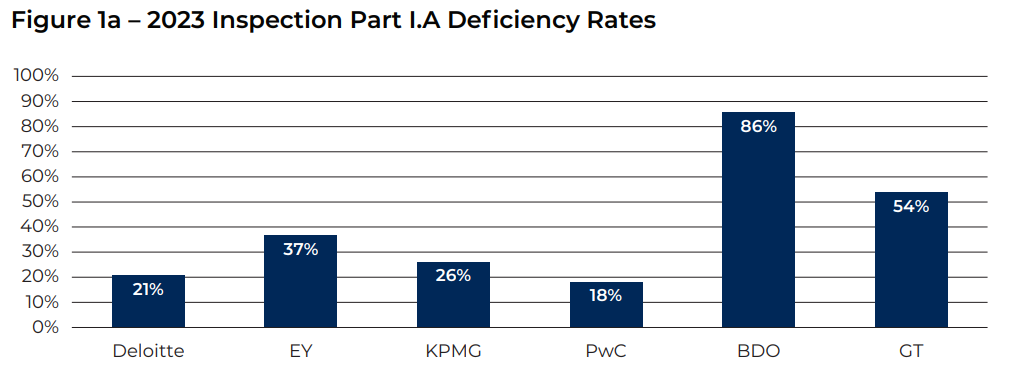

The PCAOB’s Staff Update on 2023 Inspection Activities has reported yet another rise in Part I.A deficiencies, this year rising to an overall rate of 46%, up from 2022’s rate of 40%. The PCAOB has included some explanations firms have offered for these concerning results as well as some disaggregation of the data which provides reason for optimism and some for further concern. First, firms have shared with the PCAOB that they have faced challenges in a remote work environment to deliver the appropriate training and experience to new staff. The Board’s report also seems to suggest that at times, engagement reviewers may also lack the experience, expertise and time to properly review the audit procedures, which it reiterates is the responsibility of the firms themselves.

Next, the PCAOB points to what it calls a “leveling off” in the rate of Part I.A deficiencies at some firms, namely the Big Four. As Tellen reported on recently, the rate of these deficiencies at firms is far from uniform. Some of the larger firms below the Big Four, namely Grant Thornton and BDO, have been found to have Part I.A deficiencies at a significantly higher rate than their larger counterparts. While the PCAOB only reports aggregated results of the six largest global networks, the Part I.A deficiency rates reported in 2023 by BDO and GT exceed those reported of non-affiliated firms in 2021 and 2022.

The data here are alarming, as in previous years, non-affiliated firms were largely overrepresented in the rate of findings, whereas in 2023, even the largest global networks are overrepresented and driving an increase in findings, showing that not even the largest firms (and their networks) are immune to recent trends and audit quality gaps.

Each global and national firm's 2023 inspection report can be found here.

66ea27aa0c712612e947a041_AD_4nXdjOgGYlw6Mz10Gb92p5PM82uZXgAXUgfC2NJZGev9TfzT5WjpyXa8tRlfG2IWx0mjkBMcgmGEdJSAPRNRJDMqemhdX64gOpzb_zKn5xf8HmQ4WJmbV0HEkqnPHTjl1ZXefiI_3dR04J60cOUfrEF5Vote4.png

The PCAOB's latest Part I.A deficiency findings rates for the six larrgest global networks While the PCAOB points to this leveling off of deficiency rates in certain sectors, the overall trend of increased deficiency findings has now continued for several years, with the industry's larger trends of staffing challenges showing few indicators of reversing in the short term. The PCAOB notes that firms have responded by driving a more pronounced return to in-person work, which may have both positive and negative effects on industry retention long term if other employment sectors choose to remain primarily remote.

Overall, data for the past three reporting periods has raised concern not just within the walls of the PCAOB but the industry as a whole given the potential exposure to increased liability from a reduction in audit quality. While firms have seemed to introduce some solutions, the Board notes they still struggle with their own technology at times, a particular concern as innovative and often technology driven solutions will be needed if recent quality trends are to be reversed in a challenging staffing environment. In the absence of short term solutions to these staffing constraints, firms will need to quickly upskill their existing staff on both existing and new technologies like AI in order to achieve both leverage and audit quality.